Question: Question 2 25 points Save Answer (25 points) Owen bank wants to estimate the probability of default of the firm Fizer. Fizer bonds have the

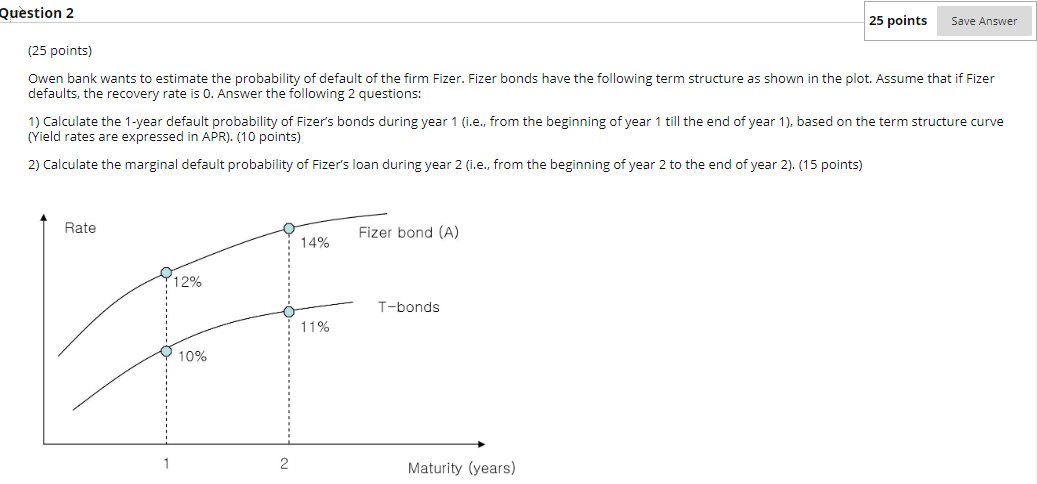

Question 2 25 points Save Answer (25 points) Owen bank wants to estimate the probability of default of the firm Fizer. Fizer bonds have the following term structure as shown in the plot. Assume that if Fizer defaults, the recovery rate is 0. Answer the following 2 questions: 1) Calculate the 1-year default probability of Fizer's bonds during year 1 (i.e, from the beginning of year 1 till the end of year 1), based on the term structure curve (Yield rates are expressed in APR). (10 points) 2) Calculate the marginal default probability of Fizer's loan during year 2 (i.e., from the beginning of year 2 to the end of year 2). (15 points) Rate Fizer bond (A) 14% Y 12% T-bonds 11% O 10% Maturity (years) Question 2 25 points Save Answer (25 points) Owen bank wants to estimate the probability of default of the firm Fizer. Fizer bonds have the following term structure as shown in the plot. Assume that if Fizer defaults, the recovery rate is 0. Answer the following 2 questions: 1) Calculate the 1-year default probability of Fizer's bonds during year 1 (i.e, from the beginning of year 1 till the end of year 1), based on the term structure curve (Yield rates are expressed in APR). (10 points) 2) Calculate the marginal default probability of Fizer's loan during year 2 (i.e., from the beginning of year 2 to the end of year 2). (15 points) Rate Fizer bond (A) 14% Y 12% T-bonds 11% O 10% Maturity (years)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts