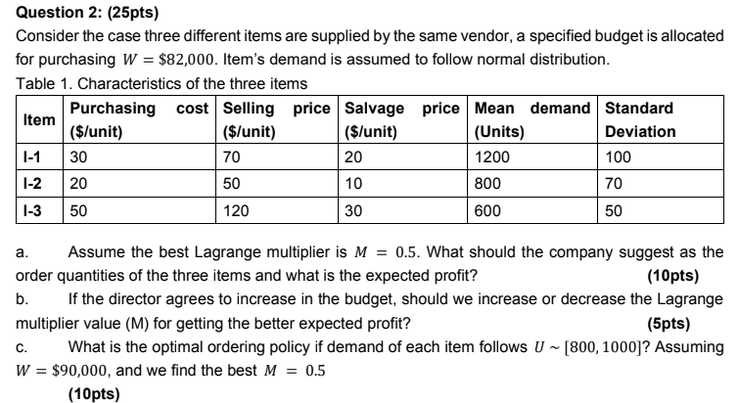

Question: Question 2: (25pts) Consider the case three different items are supplied by the same vendor, a specified budget is allocated for purchasing W = $82,000.

Question 2: (25pts) Consider the case three different items are supplied by the same vendor, a specified budget is allocated for purchasing W = $82,000. Item's demand is assumed to follow normal distribution. Table 1. Characteristics of the three items Purchasing cost Selling price Salvage price Mean demand Standard Item ($/unit) ($/unit) ($/unit) (Units) Deviation 1-1 30 1200 100 I-2 20 50 10 800 70 1-3 50 120 30 600 50 70 20 a. Assume the best Lagrange multiplier is M = 0.5. What should the company suggest as the order quantities of the three items and what is the expected profit? (10pts) b. If the director agrees to increase in the budget, should we increase or decrease the Lagrange multiplier value (M) for getting the better expected profit? (5pts) c. What is the optimal ordering policy if demand of each item follows U - [800, 1000]? Assuming W = $90,000, and we find the best M = 0.5 (10pts) Question 2: (25pts) Consider the case three different items are supplied by the same vendor, a specified budget is allocated for purchasing W = $82,000. Item's demand is assumed to follow normal distribution. Table 1. Characteristics of the three items Purchasing cost Selling price Salvage price Mean demand Standard Item ($/unit) ($/unit) ($/unit) (Units) Deviation 1-1 30 1200 100 I-2 20 50 10 800 70 1-3 50 120 30 600 50 70 20 a. Assume the best Lagrange multiplier is M = 0.5. What should the company suggest as the order quantities of the three items and what is the expected profit? (10pts) b. If the director agrees to increase in the budget, should we increase or decrease the Lagrange multiplier value (M) for getting the better expected profit? (5pts) c. What is the optimal ordering policy if demand of each item follows U - [800, 1000]? Assuming W = $90,000, and we find the best M = 0.5 (10pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts