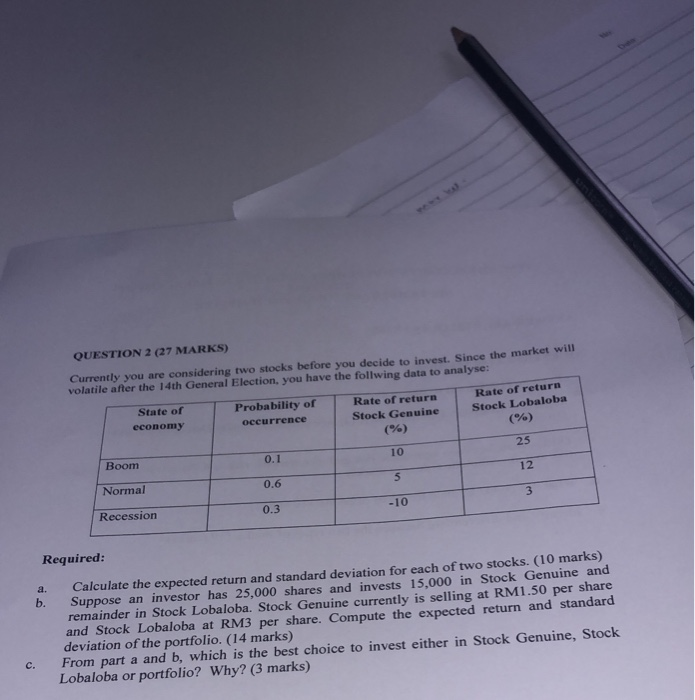

Question: QUESTION 2 (27 MARKS) Currently you are considering two stocks before you decide to invest. Since the market will volatile after the 14th General Election,

QUESTION 2 (27 MARKS) Currently you are considering two stocks before you decide to invest. Since the market will volatile after the 14th General Election, you have the follwing data to analyse State of economy Probability of occurrence Rate of return Stock Genuine Rate of return Stock Lobaloba Boom 0.1 25 10 Normal 12 Recession Required: b. Calculate the expected return and standard deviation for each of two stocks. (10 marks) Suppose an investor has 25,000 shares and invests 15,000 in Stock Genuine and remainder in Stock Lobaloba. Stock Genuine currently is selling at RM1.50 per share and Stock Lobaloba at RM3 per share. Compute the expected return and standard deviation of the portfolio. (14 marks) From part a and b, which is the best choice to invest either in Stock Genuine, Stock Lobaloba or portfolio? Why? (3 marks) c. QUESTION 2 (27 MARKS) Currently you are considering two stocks before you decide to invest. Since the market will volatile after the 14th General Election, you have the follwing data to analyse State of economy Probability of occurrence Rate of return Stock Genuine Rate of return Stock Lobaloba Boom 0.1 25 10 Normal 12 Recession Required: b. Calculate the expected return and standard deviation for each of two stocks. (10 marks) Suppose an investor has 25,000 shares and invests 15,000 in Stock Genuine and remainder in Stock Lobaloba. Stock Genuine currently is selling at RM1.50 per share and Stock Lobaloba at RM3 per share. Compute the expected return and standard deviation of the portfolio. (14 marks) From part a and b, which is the best choice to invest either in Stock Genuine, Stock Lobaloba or portfolio? Why? (3 marks) c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts