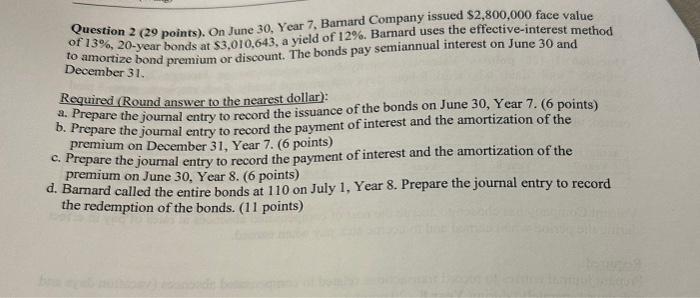

Question: Question 2 (29 points). On June 30, Year 7, Bamard Company issued $2,800,000 face value of 13%,20-year bonds at $3,010,643, a yield of 12%. Barmard

Question 2 (29 points). On June 30, Year 7, Bamard Company issued $2,800,000 face value of 13%,20-year bonds at $3,010,643, a yield of 12%. Barmard uses the effective-interest method to amortize bond premium or discount. The bonds pay semiannual interest on June 30 and December 31. Required (Round answer to the nearest dollar): a. Prepare the journal entry to record the issuance of the bonds on June 30, Year 7. (6 points) b. Prepare the journal entry to record the payment of interest and the amortization of the premium on December 31, Year 7. (6 points) c. Prepare the journal entry to record the payment of interest and the amortization of the premium on June 30 , Year 8 . (6 points) 1. Barnard called the entire bonds at 110 on July 1 , Year 8 . Prepare the journal entry to record the redemption of the bonds. (11 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts