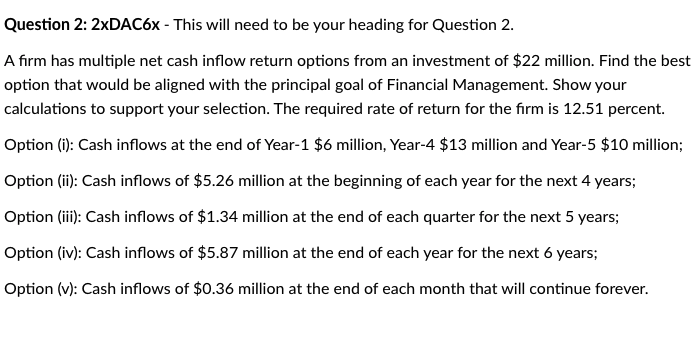

Question: Question 2: 2xDAC6x - This will need to be your heading for Question 2. A firm has multiple net cash inflow return options from an

Question 2: 2xDAC6x - This will need to be your heading for Question 2. A firm has multiple net cash inflow return options from an investment of $22 million. Find the best option that would be aligned with the principal goal of Financial Management. Show your calculations to support your selection. The required rate of return for the firm is 12.51 percent. Option (i): Cash inflows at the end of Year-1 \$6 million, Year-4 \$13 million and Year-5 \$10 million; Option (ii): Cash inflows of $5.26 million at the beginning of each year for the next 4 years; Option (iii): Cash inflows of $1.34 million at the end of each quarter for the next 5 years; Option (iv): Cash inflows of $5.87 million at the end of each year for the next 6 years; Option (v): Cash inflows of $0.36 million at the end of each month that will continue forever

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts