Question: Question 2 ( 3 0 marks ) On January 1 , 2 0 2 1 , Giselle Corporation ( Giselle ) acquired a 7 5

Question marks

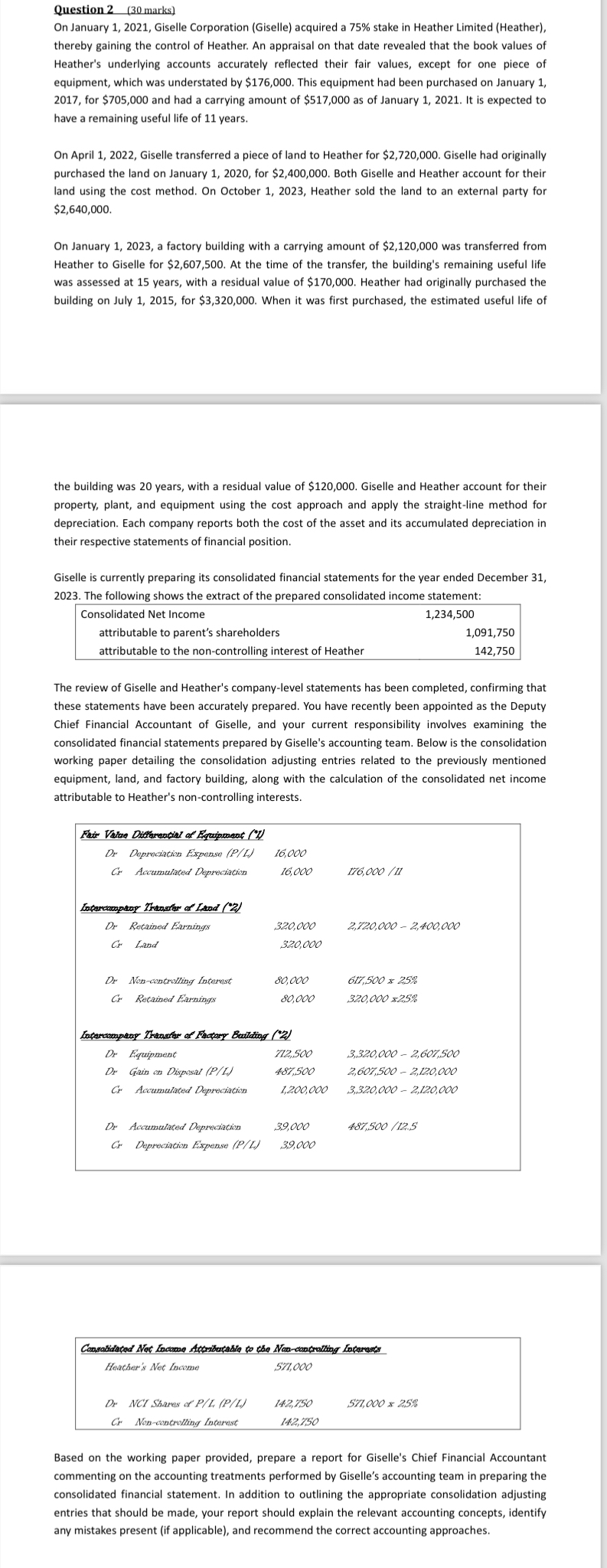

On January Giselle Corporation Giselle acquired a stake in Heather Limited Heather thereby gaining the control of Heather. An appraisal on that date revealed that the book values of Heather's underlying accounts accurately reflected their fair values, except for one piece of equipment, which was understated by $ This equipment had been purchased on January for $ and had a carrying amount of $ as of January It is expected to have a remaining useful life of years.

On April Giselle transferred a piece of land to Heather for $ Giselle had originally purchased the land on January for $ Both Giselle and Heather account for their land using the cost method. On October Heather sold the land to an external party for $

On January a factory building with a carrying amount of $ was transferred from Heather to Giselle for $ At the time of the transfer, the building's remaining useful life was assessed at years, with a residual value of $ Heather had originally purchased the building on July for $ When it was first purchased, the estimated useful life of

the building was years, with a residual value of $ Giselle and Heather account for their property, plant, and equipment using the cost approach and apply the straightline method for depreciation. Each company reports both the cost of the asset and its accumulated depreciation in their respective statements of financial position.

Giselle is currently preparing its consolidated financial statements for the year ended December The following shows the extract of the prepared consolidated income statement:

tableConsolidated Net Income,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock