Question: Question 2 3 1 pts The Zens v . Quinlan case stands for the proposition that: When a taxpayer uses a circuitous approsch in an

Question

pts

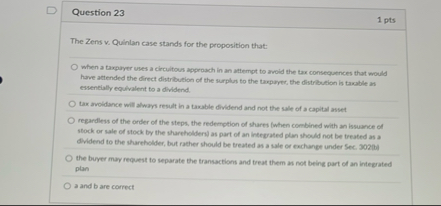

The Zens v Quinlan case stands for the proposition that:

When a taxpayer uses a circuitous approsch in an attempt to avoid the tax consequences that would have attended the direct distribution of the surplen to the taxpyres, the distribution is taxabie as essentially equivalent to a dividend.

tax avoidance will alwars result in a turabie dividend and not the sle of a capital asset

regardless of the order of the steps, the redemption of shares when combined with an issuance of stock or sale of stock by the shareholderil as part of an integated plan should not be treated as a

the buyer may request to separate the transactions and treat them as not being part of an integrated plan

and b are correct

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock