Question: Question 2 ( 3 5 marks ) Necks Auto are retailers who purchase and sell vehicle parts & accessories, including batteries. The business uses a

Question

marks

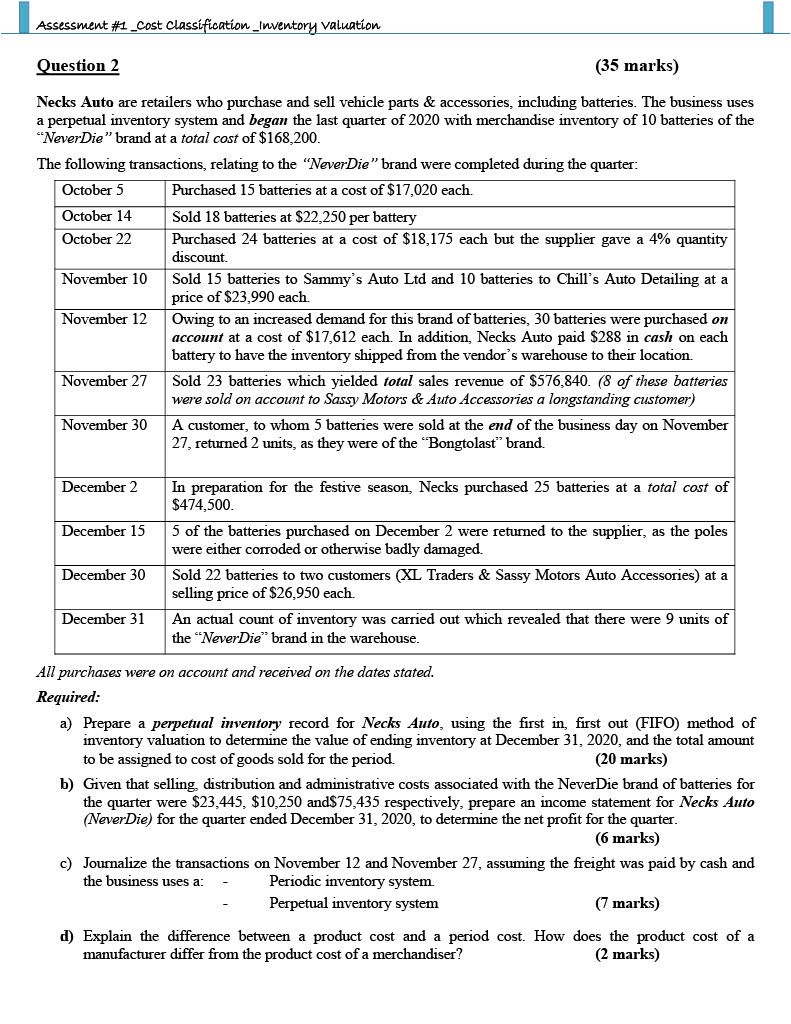

Necks Auto are retailers who purchase and sell vehicle parts & accessories, including batteries. The business uses

a perpetual inventory system and began the last quarter of with merchandise inventory of batteries of the

"NeverDie" brand at a total cost of $

The following transactions, relating to the "NeverDie" brand were completed during the quarter:

All purchases were on account and received on the dates stated.

Required:

a Prepare a perpetual inventory record for Necks Auto, using the first in first out FIFO method of

inventory valuation to determine the value of ending inventory at December and the total amount

to be assigned to cost of goods sold for the period.

b Given that selling distribution and administrative costs associated with the NeverDie brand of batteries for

the quarter were $$ and $ respectively, prepare an income statement for Necks Auto

NeverDie for the quarter ended December to determine the net profit for the quarter.

marks

c Journalize the transactions on November and November assuming the freight was paid by cash and

the business uses a: Periodic inventory system.

Perpetual inventory system

marks

d Explain the difference between a product cost and a period cost. How does the product cost of a

manufacturer differ from the product cost of a merchandiser?

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock