Question: QUESTION 2 ( 3 6 marks ) Aromatic ( Pty ) Ltd ( Aromatic ) is a South African coffee roastery and retailer

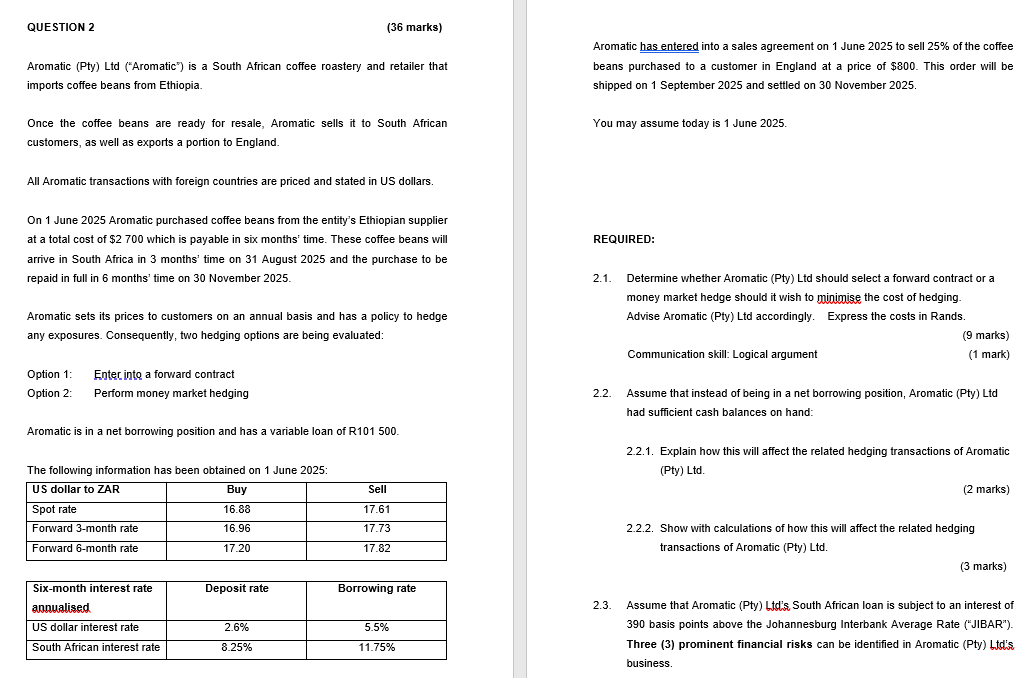

QUESTION marks Aromatic Pty Ltd Aromatic is a South African coffee roastery and retailer that imports coffee beans from Ethiopia. Once the coffee beans are ready for resale, Aromatic sells it to South African customers, as well as exports a portion to England. All Aromatic transactions with foreign countries are priced and stated in US dollars. On June Aromatic purchased coffee beans from the entity's Ethiopian supplier at a total cost of $ which is payable in six months' time. These coffee beans will arrive in South Africa in months' time on August and the purchase to be repaid in full in months' time on November Aromatic sets its prices to customers on an annual basis and has a policy to hedge any exposures. Consequently, two hedging options are being evaluated: Option : Enter into a forward contract Option : Perform money market hedging Aromatic is in a net borrowing position and has a variable loan of R The following information has been obtained on June : Aromatic has entered into a sales agreement on June to sell of the coffee beans purchased to a customer in England at a price of $ This order will be shipped on September and settled on November You may assume today is June REQUIRED: Determine whether Aromatic Pty Ltd should select a forward contract or a money market hedge should it wish to minimise the cost of hedging. Advise Aromatic Pty Ltd accordingly. Express the costs in Rands. Communication skill: Logical argument Assume that instead of being in a net borrowing position, Aromatic Pty Ltd had sufficient cash balances on hand: Explain how this will affect the related hedging transactions of Aromatic Pty Ltd Show with calculations of how this will affect the related hedging transactions of Aromatic Pty Ltd Assume that Aromatic Pty Ltds South African loan is subject to an interest of basis points above the Johannesburg Interbank Average Rate JIBAR Three prominent financial risks can be identified in Aromatic Pty Ltds business.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock