Question: question 2 & 3 please Cash flows from a new project are expected to be $6,000,$10,000,$18,000, and $25,000 over the next 4 years, respectively. Assuming

question 2 & 3 please

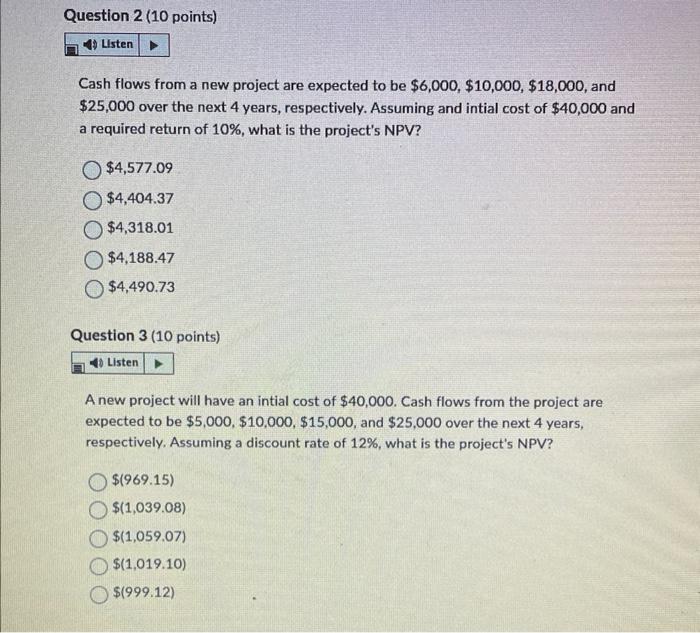

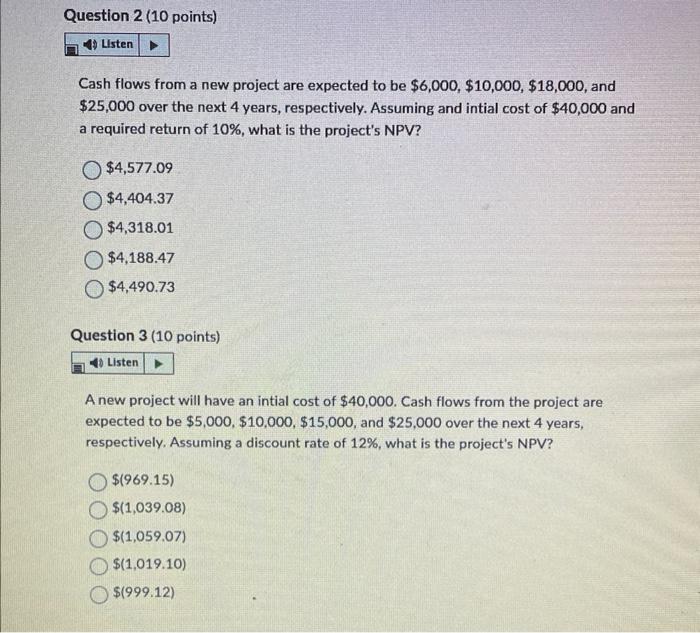

Cash flows from a new project are expected to be $6,000,$10,000,$18,000, and $25,000 over the next 4 years, respectively. Assuming and intial cost of $40,000 and a required return of 10%, what is the project's NPV? $4,577.09$4,404.37$4,318.01$4,188.47$4,490.73 Question 3 (10 points) A new project will have an intial cost of $40,000. Cash flows from the project are expected to be $5,000,$10,000,$15,000, and $25,000 over the next 4 years, respectively, Assuming a discount rate of 12%, what is the project's NPV? $(969.15)$(1,039.08)$(1,059.07)$(1,019.10)$(999.12)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock