Question: Question 2 (3 points) Given the following information on: . Initial Investment Cost of Capital Expected cash inflow and outflow Rank the following projects by

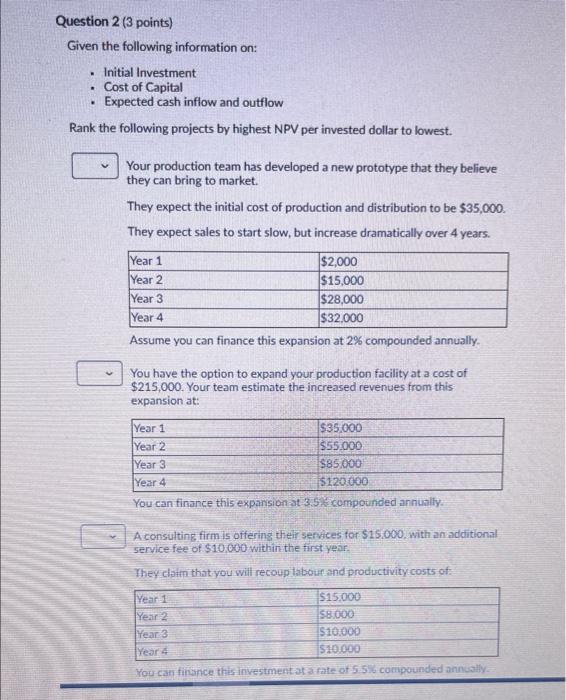

Question 2 (3 points) Given the following information on: . Initial Investment Cost of Capital Expected cash inflow and outflow Rank the following projects by highest NPV per invested dollar to lowest. Your production team has developed a new prototype that they believe they can bring to market. They expect the initial cost of production and distribution to be $35,000. They expect sales to start slow, but increase dramatically over 4 years. Year 1 $2,000 Year 2 $15,000 Year 3 $28,000 Year 4 $32.000 Assume you can finance this expansion at 2% compounded annually. You have the option to expand your production facility at a cost of $215,000. Your team estimate the increased revenues from this expansion at: Year 1 $35.000 Year 2 $55.000 Year 3 $85.000 Year 4 $120.000 You can finance this expansion at 3.5k compounded annually. A consulting firm is offering their services for $15.000, with an additional service fee of $10.000 within the first year. They claim that you will recoup labour and productivity costs of Year1 $15.000 Year 2 58.000 Year 3 1510.000 Year 4 $10.000 You can finance this investment at a rate of 5. Si compounded annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts