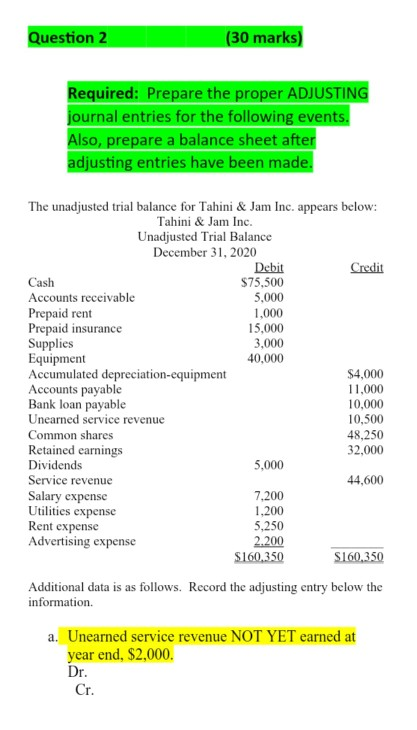

Question: Question 2 (30 marks) Required: Prepare the proper ADJUSTING journal entries for the following events. Also, prepare a balance sheet after adjusting entries have been

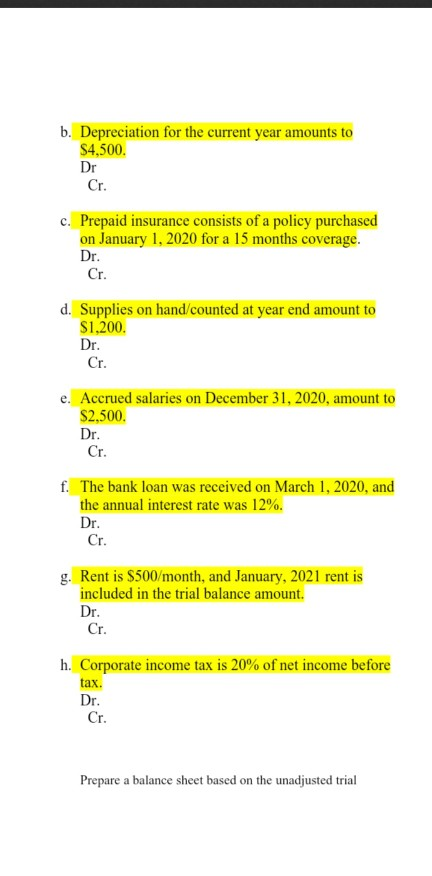

Question 2 (30 marks) Required: Prepare the proper ADJUSTING journal entries for the following events. Also, prepare a balance sheet after adjusting entries have been made. The unadjusted trial balance for Tahini & Jam Inc. appears below: Tahini & Jam Inc. Unadjusted Trial Balance December 31, 2020 Debit Credit Cash $75,500 Accounts receivable 5,000 Prepaid rent 1,000 Prepaid insurance 15,000 Supplies 3,000 Equipment 40,000 Accumulated depreciation-equipment $4,000 Accounts payable 11,000 Bank loan payable 10,000 Unearned service revenue 10,500 Common shares 48,250 Retained earnings 32,000 Dividends 5,000 Service revenue 44,600 Salary expense 7.200 Utilities expense 1,200 Rent expense 5,250 Advertising expense 2.200 $160.350 S160.350 Additional data is as follows. Record the adjusting entry below the information a. Unearned service revenue NOT YET earned at year end, $2,000. Dr. Cr. b. Depreciation for the current year amounts to $4,500. Dr Cr. c. Prepaid insurance consists of a policy purchased on January 1, 2020 for a 15 months coverage. Dr. Cr. d. Supplies on hand/counted at year end amount to $1,200. Dr. Cr. e. Accrued salaries on December 31, 2020, amount to $2,500. Dr. Cr. f. The bank loan was received on March 1, 2020, and the annual interest rate was 12%. Dr. Cr. g. Rent is $500/month, and January, 2021 rent is included in the trial balance amount. Dr. Cr. h. Corporate income tax is 20% of net income before tax. Dr. Cr. Prepare a balance sheet based on the unadjusted trial

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts