Question: Question 2 30 Marks You recently accepted an assignment with Oxford Limited as a financial consultant. One of your first assignments is the analysis of

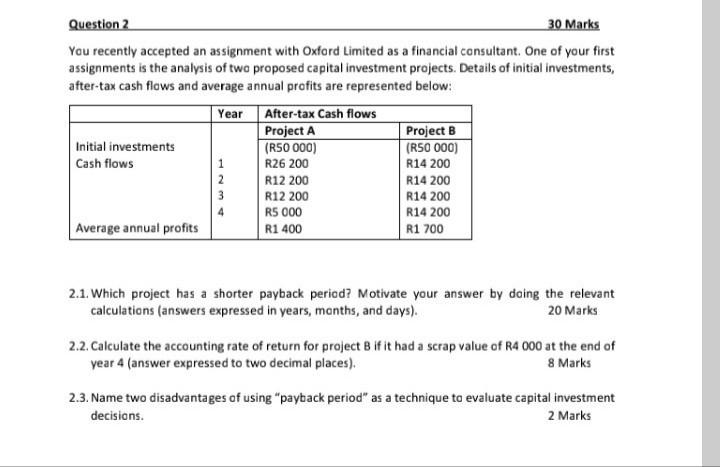

Question 2 30 Marks You recently accepted an assignment with Oxford Limited as a financial consultant. One of your first assignments is the analysis of two proposed capital investment projects. Details of initial investments, after-tax cash flows and average annual profits are represented below: Year After-tax Cash flows Project A Project B Initial investments (R50 000) (R50 000) Cash flows R26 200 R14 200 2 R12 200 R14 200 3 R12 200 R14 200 RS 000 R14 200 Average annual profits R1 400 R1 700 2.1. Which project has a shorter payback period? Motivate your answer by doing the relevant calculations (answers expressed in years, months, and days). 20 Marks 2.2. Calculate the accounting rate of return for project B if it had a scrap value of R4 000 at the end of year 4 (answer expressed to two decimal places). 8 Marks 2.3. Name two disadvantages of using "payback period" as a technique to evaluate capital investment decisions. 2 Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock