Question: QUESTION 2 (33 Marks) Part (A) (i) Identify THREE differences of the accounting measurement between Goodwill and Property, Plant and Equipment. Discuss the rationale to

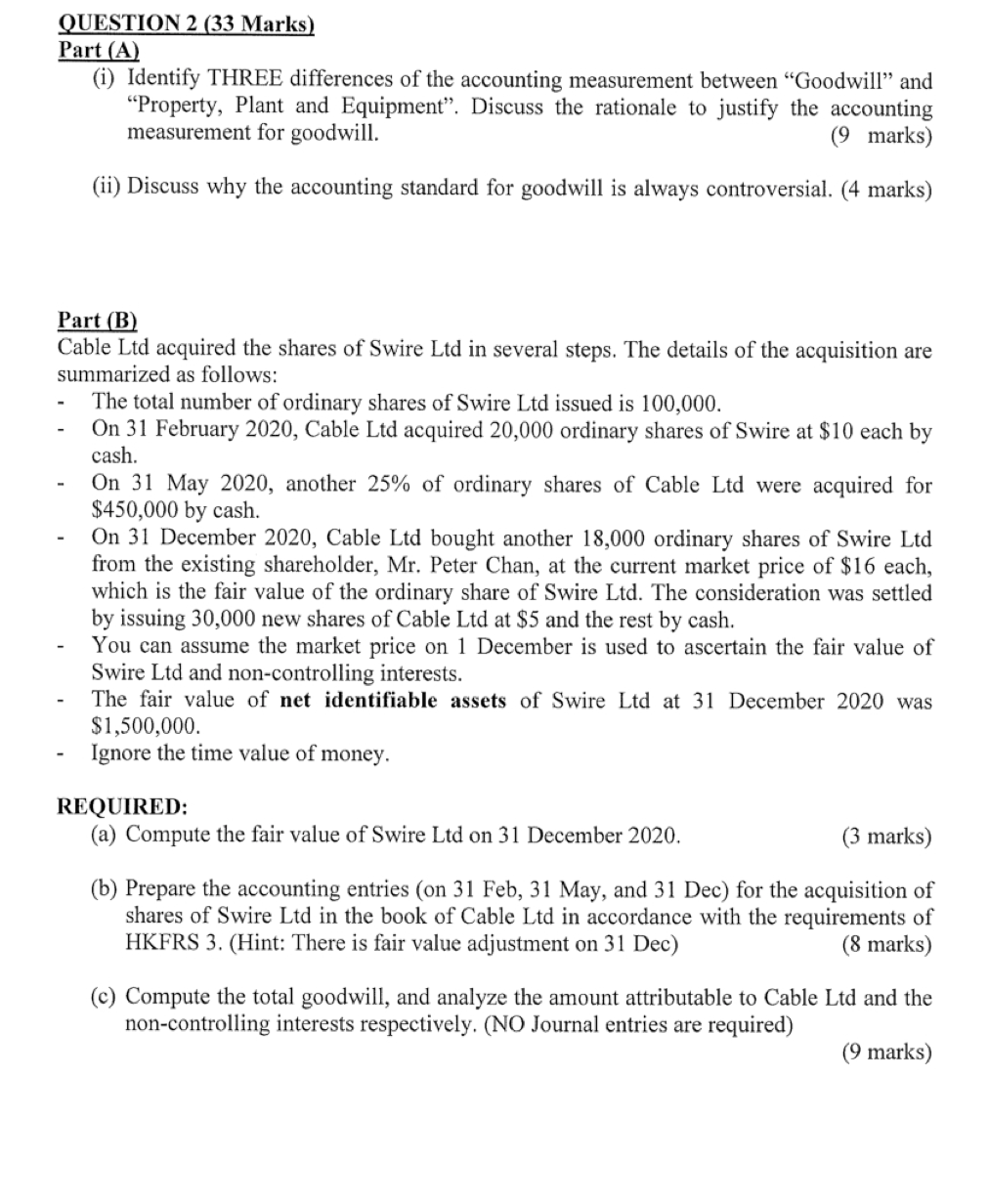

QUESTION 2 (33 Marks) Part (A) (i) Identify THREE differences of the accounting measurement between Goodwill and Property, Plant and Equipment. Discuss the rationale to justify the accounting measurement for goodwill. (9 marks) (ii) Discuss why the accounting standard for goodwill is always controversial. (4 marks) Part (B) Cable Ltd acquired the shares of Swire Ltd in several steps. The details of the acquisition are summarized as follows: The total number of ordinary shares of Swire Ltd issued is 100,000. On 31 February 2020, Cable Ltd acquired 20,000 ordinary shares of Swire at $10 each by cash. On 31 May 2020, another 25% of ordinary shares of Cable Ltd were acquired for $450,000 by cash. On 31 December 2020, Cable Ltd bought another 18,000 ordinary shares of Swire Ltd from the existing shareholder, Mr. Peter Chan, at the current market price of $16 each, which is the fair value of the ordinary share of Swire Ltd. The consideration was settled by issuing 30,000 new shares of Cable Ltd at $5 and the rest by cash. You can assume the market price on 1 December is used to ascertain the fair value of Swire Ltd and non-controlling interests. The fair value of net identifiable assets of Swire Ltd at 31 December 2020 was $1,500,000 Ignore the time value of money. REQUIRED: (a) Compute the fair value of Swire Ltd on 31 December 2020. (3 marks) (b) Prepare the accounting entries (on 31 Feb, 31 May, and 31 Dec) for the acquisition of shares of Swire Ltd in the book of Cable Ltd in accordance with the requirements of HKFRS 3. (Hint: There is fair value adjustment on 31 Dec) (8 marks) (c) Compute the total goodwill, and analyze the amount attributable to Cable Ltd and the non-controlling interests respectively. (NO Journal entries are required) (9 marks) QUESTION 2 (33 Marks) Part (A) (i) Identify THREE differences of the accounting measurement between Goodwill and Property, Plant and Equipment. Discuss the rationale to justify the accounting measurement for goodwill. (9 marks) (ii) Discuss why the accounting standard for goodwill is always controversial. (4 marks) Part (B) Cable Ltd acquired the shares of Swire Ltd in several steps. The details of the acquisition are summarized as follows: The total number of ordinary shares of Swire Ltd issued is 100,000. On 31 February 2020, Cable Ltd acquired 20,000 ordinary shares of Swire at $10 each by cash. On 31 May 2020, another 25% of ordinary shares of Cable Ltd were acquired for $450,000 by cash. On 31 December 2020, Cable Ltd bought another 18,000 ordinary shares of Swire Ltd from the existing shareholder, Mr. Peter Chan, at the current market price of $16 each, which is the fair value of the ordinary share of Swire Ltd. The consideration was settled by issuing 30,000 new shares of Cable Ltd at $5 and the rest by cash. You can assume the market price on 1 December is used to ascertain the fair value of Swire Ltd and non-controlling interests. The fair value of net identifiable assets of Swire Ltd at 31 December 2020 was $1,500,000 Ignore the time value of money. REQUIRED: (a) Compute the fair value of Swire Ltd on 31 December 2020. (3 marks) (b) Prepare the accounting entries (on 31 Feb, 31 May, and 31 Dec) for the acquisition of shares of Swire Ltd in the book of Cable Ltd in accordance with the requirements of HKFRS 3. (Hint: There is fair value adjustment on 31 Dec) (8 marks) (c) Compute the total goodwill, and analyze the amount attributable to Cable Ltd and the non-controlling interests respectively. (NO Journal entries are required) (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts