Question: Question 2 (35 points): Given the information below for Bond A and Bond B, do the following questions and display formulas ased (1) Calculate coupen

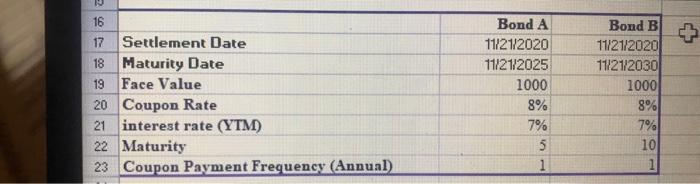

Question 2 (35 points): Given the information below for Bond A and Bond B, do the following questions and display formulas ased (1) Calculate coupen amount and bond price for Bond A and Bond B. (10 points) (2) Calculate the Macaulay duration for Bond A using the "step-by-step" method and the Macaulay duration for Bond B using the Eacel built-in function (10 poumi) (3) Calculate the Convexity for Boad A and the percentage change in bond price for Beed A by using Duration abd Convexity if intersest rate decreases by 15 . (10 poanta) (4) Which bond has greater intereit rate risk and why? Answer this part in the given text box ( 5 points) \begin{tabular}{|l|l|rr|} \hline 16 & Bond A & Bond B \\ \hline 17 & Settlement Date & 11/21/2020 & 11/21/2020 \\ \hline 18 & Maturity Date & 11/21/2025 & 11/21/2030 \\ \hline 19 & Face Value & 1000 & 1000 \\ \hline 20 & Coupon Rate & 8% & 8% \\ \hline 21 & interest rate (YTM) & 7% & 7% \\ 22 & Maturity & 5 & 10 \\ \hline 23 & Coupon Payment Frequency (Annual) & 1 & 1 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts