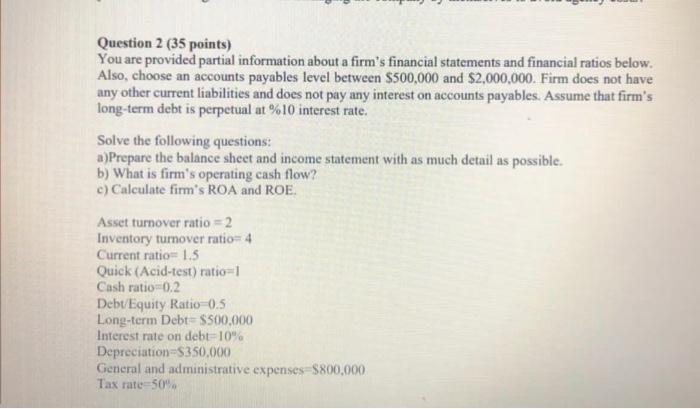

Question: Question 2 (35 points) You are provided partial information about a firm's financial statements and financial ratios below. Also, choose an accounts payables level between

Question 2 (35 points) You are provided partial information about a firm's financial statements and financial ratios below. Also, choose an accounts payables level between $500,000 and $2,000,000. Firm does not have any other current liabilities and does not pay any interest on accounts payables. Assume that firm's long-term debt is perpetual at %10 interest rate. Solve the following questions: a)Prepare the balance sheet and income statement with as much detail as possible. b) What is firm's operating cash flow? c) Calculate firm's ROA and ROE. Asset turnover ratio = 2 Inventory turnover ratio 4 Current ratio=1.5 Quick (Acid-test) ratio=1 Cash ratio=0.2 Debt/Equity Ratio=0.5 Long-term Debt-$500,000 Interest rate on debt 10% Depreciation=S350,000 General and administrative expenses $800,000 Tax rate 50% Question 2 (35 points) You are provided partial information about a firm's financial statements and financial ratios below. Also, choose an accounts payables level between $500,000 and $2,000,000. Firm does not have any other current liabilities and does not pay any interest on accounts payables. Assume that firm's long-term debt is perpetual at %10 interest rate. Solve the following questions: a)Prepare the balance sheet and income statement with as much detail as possible. b) What is firm's operating cash flow? c) Calculate firm's ROA and ROE. Asset turnover ratio = 2 Inventory turnover ratio 4 Current ratio=1.5 Quick (Acid-test) ratio=1 Cash ratio=0.2 Debt/Equity Ratio=0.5 Long-term Debt-$500,000 Interest rate on debt 10% Depreciation=S350,000 General and administrative expenses $800,000 Tax rate 50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts