Question: Question 2 4 1 0 pts In 2 0 1 8 , Royce Lewis was granted 5 0 0 nonqualified stock options ( NQOs )

Question

pts

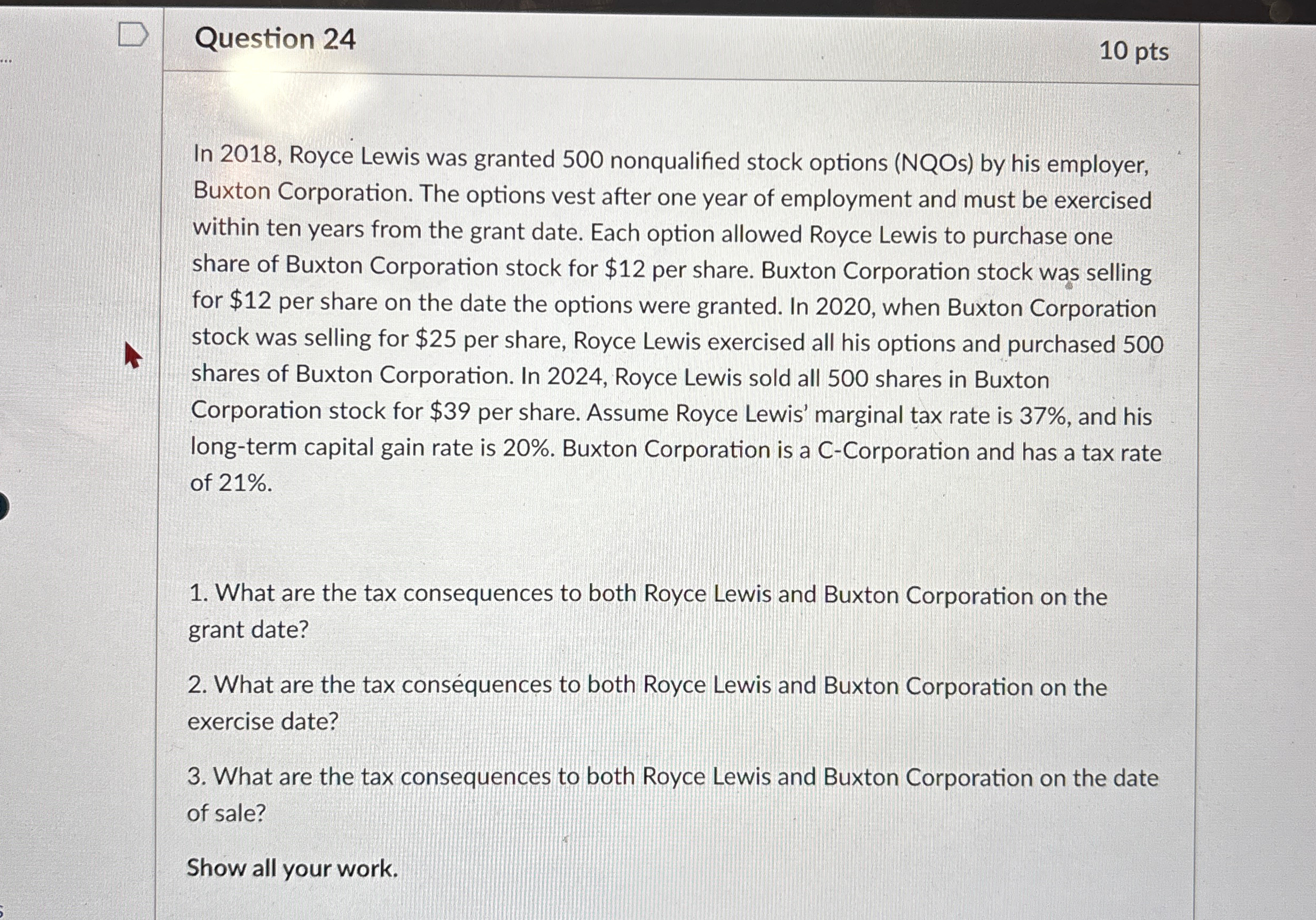

In Royce Lewis was granted nonqualified stock options NQOs by his employer, Buxton Corporation. The options vest after one year of employment and must be exercised within ten years from the grant date. Each option allowed Royce Lewis to purchase one share of Buxton Corporation stock for $ per share. Buxton Corporation stock was selling for $ per share on the date the options were granted. In when Buxton Corporation stock was selling for $ per share, Royce Lewis exercised all his options and purchased shares of Buxton Corporation. In Royce Lewis sold all shares in Buxton Corporation stock for $ per share. Assume Royce Lewis' marginal tax rate is and his longterm capital gain rate is Buxton Corporation is a CCorporation and has a tax rate of

What are the tax consequences to both Royce Lewis and Buxton Corporation on the grant date?

What are the tax consequences to both Royce Lewis and Buxton Corporation on the exercise date?

What are the tax consequences to both Royce Lewis and Buxton Corporation on the date of sale?

Show all your work.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock