Question: Question 2 4 ( 1 2 marks ) During the 2 0 2 4 taxation year ending December 3 1 , the Renaud family trust

Question marks

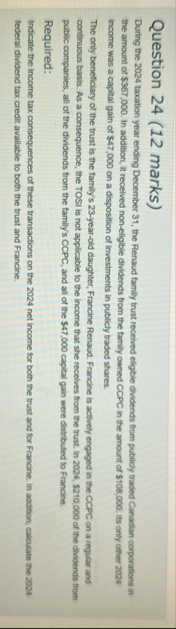

During the taxation year ending December the Renaud family trust recelved ellgible dividends from publicly traded Canadian corporations in the amount of $ In addition, it received noneligible dividends from the family owned CCPC in the amount of $ Its only other income was a capital gain of $ on a disposition of investments in publicly traded shares.

The only beneficlary of the trust is the family's yearold daughter, Francine Renaud. Francine is actively engaged in the CCPC on a regular and continuous basis. As a consequence, the TOSI is not applicable to the income that she recelves from the trust. In $ of the dividends from public companies, all of the dividends from the family's CCPC and all of the $ capital gain were distributed to Francine.

Required:

Indicate the income tax consequences of these transactions on the net income for both the trust and for Francine. In addition, calculate the federal dividend tax credit available to both the trust and Francine.Question marks

During the taxation year ending December the Renaud family trust recelved ellgible dividends from publicly traded Canadian corporations in the amount of $ In addition, it received noneligible dividends from the family owned CCPC in the amount of $ Its only other income was a capital gain of $ on a disposition of investments in publicly traded shares.

The only beneficlary of the trust is the family's yearold daughter, Francine Renaud. Francine is actively engaged in the CCPC on a regular and continuous basis. As a consequence, the TOSI is not applicable to the income that she recelves from the trust. In $ of the dividends from public companies, all of the dividends from the family's CCPC and all of the $ capital gain were distributed to Francine.

Required:

Indicate the income tax consequences of these transactions on the net income for both the trust and for Francine. In addition, calculate the federal dividend tax credit available to both the trust and Francine.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock