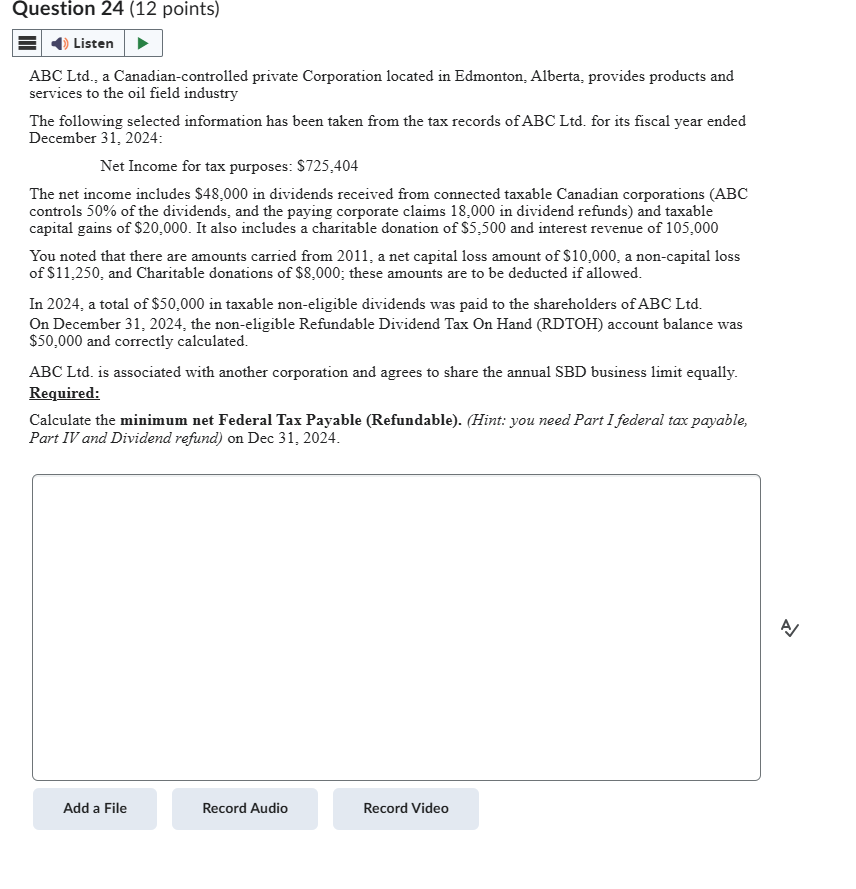

Question: Question 2 4 ( 1 2 points ) E ABC Ltd . , a Canadian - controlled private Corporation located in Edmonton, Alberta, provides products

Question points E ABC Ltd a Canadiancontrolled private Corporation located in Edmonton, Alberta, provides products and services to the oil field industry The following selected information has been taken from the tax records of ABC Ltd for its fiscal year ended December : Net Income for tax purposes: $ The net income includes $ in dividends received from connected taxable Canadian corporations ABC controls of the dividends, and the paying corporate claims in dividend refunds and taxable capital gains of $ It also includes a charitable donation of $ and interest revenue of You noted that there are amounts carried from a net capital loss amount of $ a noncapital loss of $ and Charitable donations of $ ; these amounts are to be deducted if allowed. In a total of $ in taxable noneligible dividends was paid to the shareholders of ABC Ltd On December the noneligible Refundable Dividend Tax On Hand RDTOH account balance was $ and correctly calculated. ABC Ltd is associated with another corporation and agrees to share the annual SBD business limit equally. Required: Calculate the minimum net Federal Tax Payable RefundableHint: you need Part I federal tax payable, Part IV and Dividend refund on Dec

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock