Question: Question 2 4 ( 1 point ) Soved Marbles Inc. is an accrual basis taxpayer that sells furniture. On December 1 5 , 2 0

Question point

Soved

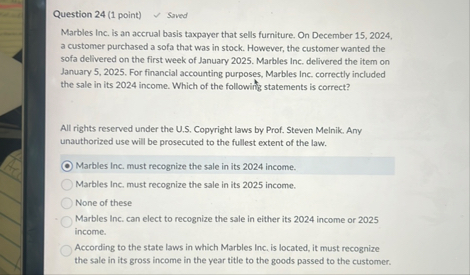

Marbles Inc. is an accrual basis taxpayer that sells furniture. On December a customer purchased a sofa that was in stock. However, the customer wanted the sofa delivered on the first week of January Marbles Inc. delivered the item on January For financial accounting purposes, Marbles Inc. correctly included the sale in its income. Which of the following statements is correct?

All rights reserved under the US Copyright laws by Prof. Steven Melnik. Any unauthorized use will be prosecuted to the fullest extent of the law.

Marbles Inc. must recognize the sale in its income.

Marbles Inc. must recognize the sale in its income.

None of these

Marbles Inc. can elect to recognize the sale in either its income or income.

According to the state laws in which Marbles Inc. is located, it must recognize the sale in its gross income in the year title to the goods passed to the customer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock