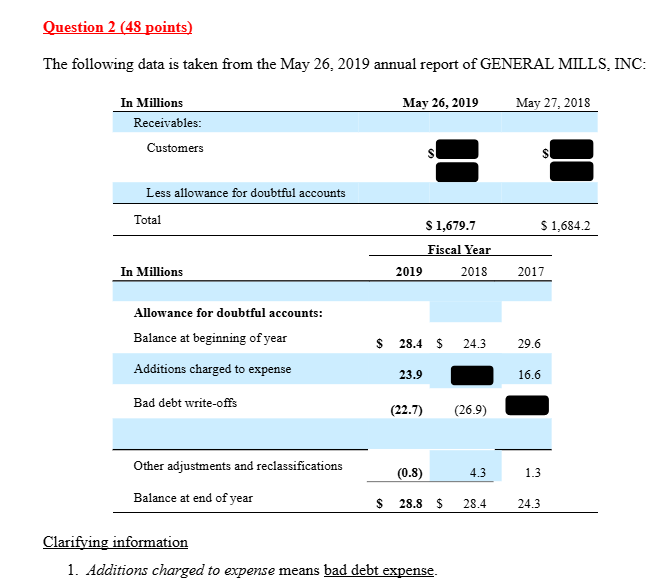

Question: Question 2 ( 4 8 points ) The following data is taken from the May 2 6 , 2 0 1 9 annual report of

Question points

The following data is taken from the May annual report of GENERAL MILLS, INC:

Clarifying information

Additions charged to expense means bad debt expense.

a What percent of Gross Accounts Receivable does the Allowance for Doubtful Accounts represent as of May Did that percentage increase or decrease in relative to

b Provide the accounting entry to record bad debt expense and writeoffs in You can record the transaction using the accounting equation or a journal entry.

c Calculate the bad debt expense for and the writeoffs in

d Suppose General Mills uses the income statement approach to determine the allowance for doubtful accounts, and the company estimated that of the gross credit sales would not be collected in What are the gross credit sales in

eSuppose General Mills uses the balance sheet approach to determine the allowance for doubtful accounts, and the company estimated that of the remaining accounts receivable in would not be collected. What is the bad debt expense in Assume that the ending balance of accounts receivable is $ million in writeoffs during are $ million, and no other adjustments and reclassifications were made during

f On Jan General Mills collected $ million of accounts receivables from its customer that had previously been writtenoff. What is the accounting entry that General Mills recorded to reflect the recovery of these accounts receivables? You can record the transaction using the accounting equation or a journal entry.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock