Question: Question 2 (4 marks) Calico has the following capital structure, which it considers to be optimal: debt 25% ( Calico has only long-term debt), preferred

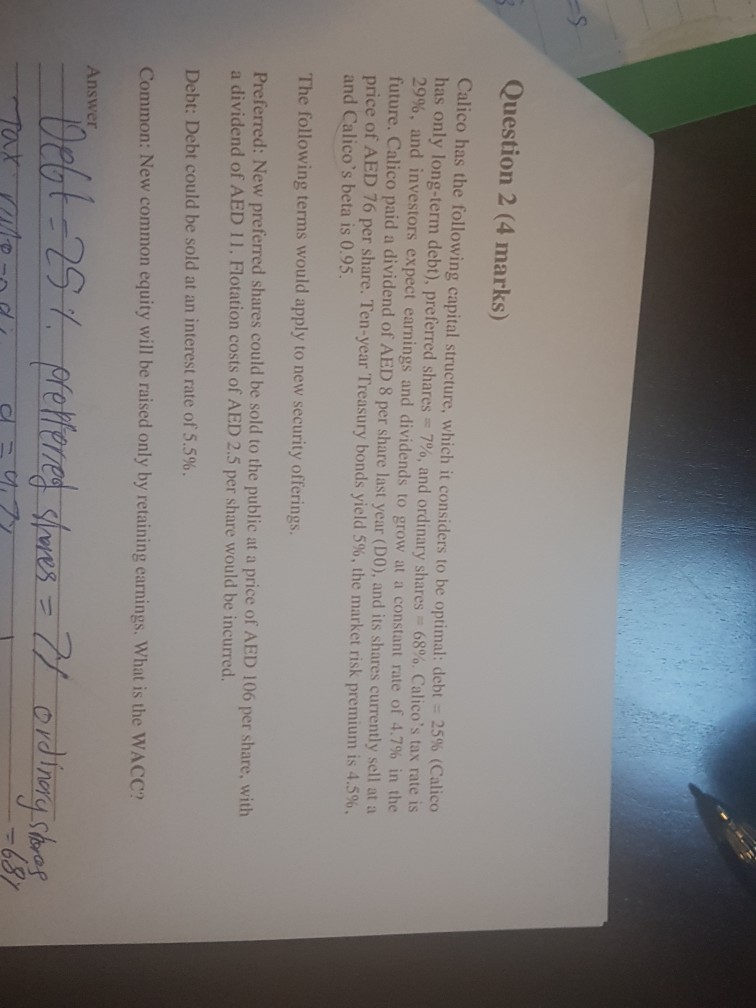

Question 2 (4 marks) Calico has the following capital structure, which it considers to be optimal: debt 25% ( Calico has only long-term debt), preferred shares =7%, and ordinary shares 68%. Calico's tax rate is 29%, and investors expect earnings and dividends to grow at a constant rate of 4.7 % in the future. Calico paid a dividend of AED 8 per share last year (DO), and its shares currently sell at a price of AED 76 per share. Ten-year Treasury bonds yield 5 %, the market risk premium is 4.5 %. and Calico's beta is 0.95. The following terms would apply to new security offerings. Preferred: New preferred shares could be sold to the public at a price of AED 106 per share, with a dividend of AED 11. Flotation costs of AED 2.5 per share would be incurred. Debt: Debt could be sold at an interest rate of 5.5 %. Common: New common equity will be raised only by retaining earnings. What is the WACC? Debt 25 pretfert Answer flowes= 7 ordineng shg Taax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts