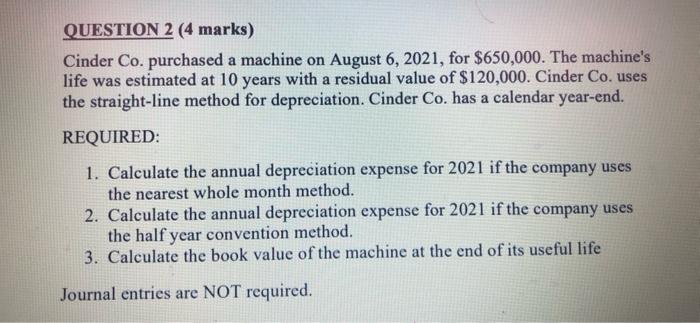

Question: QUESTION 2 (4 marks) Cinder Co. purchased a machine on August 6, 2021, for $650,000. The machine's life was estimated at 10 years with a

QUESTION 2 (4 marks) Cinder Co. purchased a machine on August 6, 2021, for $650,000. The machine's life was estimated at 10 years with a residual value of $120,000. Cinder Co. uses the straight-line method for depreciation. Cinder Co. has a calendar year-end. REQUIRED: 1. Calculate the annual depreciation expense for 2021 if the company uses the nearest whole month method. 2. Calculate the annual depreciation expense for 2021 if the company uses the half year convention method. 3. Calculate the book value of the machine at the end of its useful life Journal entries are NOT required

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock