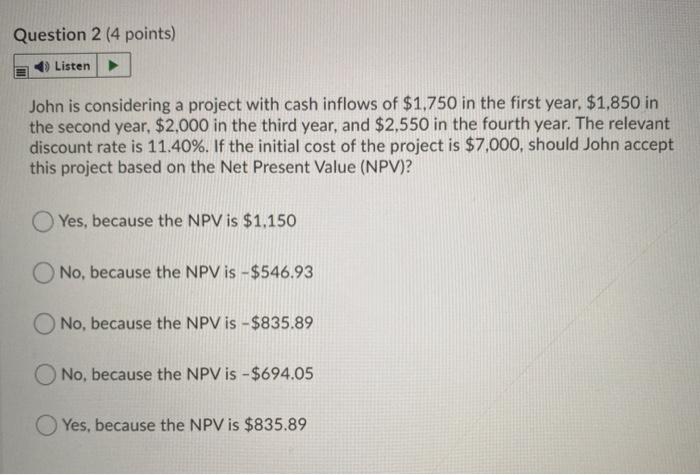

Question: Question 2 (4 points) 4) Listen John is considering a project with cash inflows of $1,750 in the first year, $1,850 in the second year,

Question 2 (4 points) 4) Listen John is considering a project with cash inflows of $1,750 in the first year, $1,850 in the second year, $2,000 in the third year, and $2,550 in the fourth year. The relevant discount rate is 11.40%. If the initial cost of the project is $7,000, should John accept this project based on the Net Present Value (NPV)? Yes, because the NPV is $1,150 O No, because the NPV is - $546.93 No, because the NPV is - $835.89 No, because the NPV is - $694.05 Yes, because the NPV is $835.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts