Question: Question 2 (4 points) Saved On December 31, 2019, the end of the fiscal year, Johnson Inc. completed the sale of a manufacturing division for

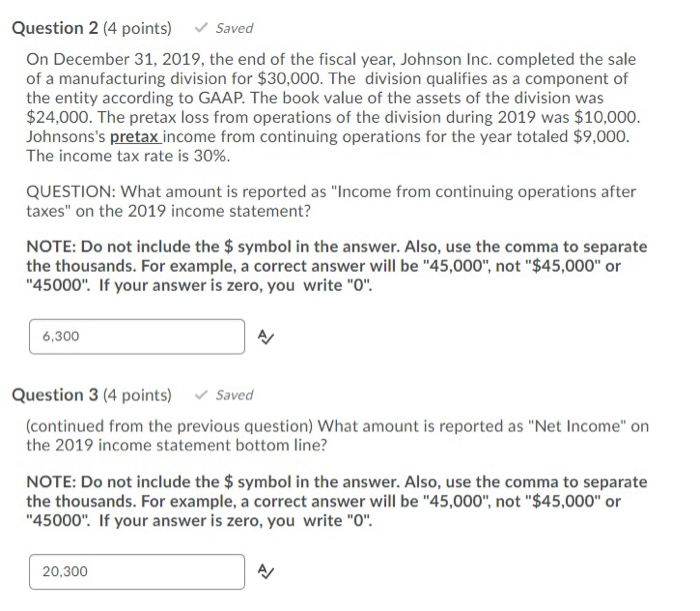

Question 2 (4 points) Saved On December 31, 2019, the end of the fiscal year, Johnson Inc. completed the sale of a manufacturing division for $30,000. The division qualifies as a component of the entity according to GAAP. The book value of the assets of the division was $24,000. The pretax loss from operations of the division during 2019 was $10,000. Johnsons's pretax income from continuing operations for the year totaled $9,000. The income tax rate is 30%. QUESTION: What amount is reported as "Income from continuing operations after taxes" on the 2019 income statement? NOTE: Do not include the $ symbol in the answer. Also, use the comma to separate the thousands. For example, a correct answer will be "45,000", not "$45,000" or "45000". If your answer is zero, you write "O". 6,300 Question 3 (4 points) Saved (continued from the previous question) What amount is reported as "Net Income" on the 2019 income statement bottom line? NOTE: Do not include the $ symbol in the answer. Also, use the comma to separate the thousands. For example, a correct answer will be "45,000", not "$45,000" or "45000". If your answer is zero, you write "O". 20,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts