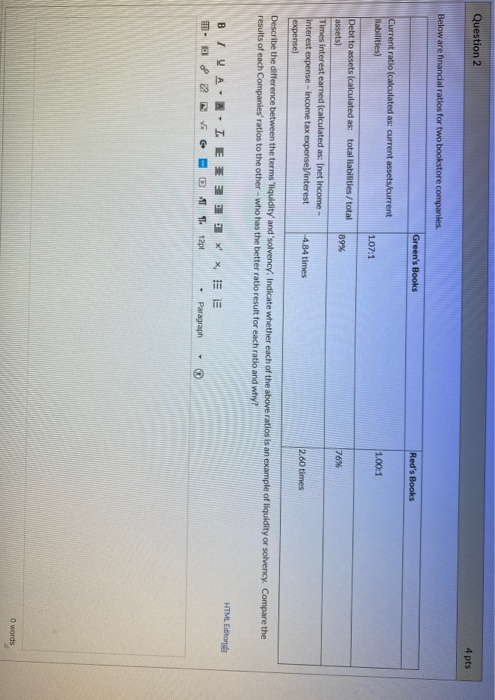

Question: Question 2 4 pts Below are financial ratios for two bookstore companies. Green's Books Red's Books Current ratio (calculated as: current assets/current Habilities) 1.00:1 1.07:1

Question 2 4 pts Below are financial ratios for two bookstore companies. Green's Books Red's Books Current ratio (calculated as: current assets/current Habilities) 1.00:1 1.07:1 8996 7626 Debt to assets (calculated as: total liabilities/total assets) Times interest earned (calculated as: Inet Income - interest expense-income tax expense interest expense) 4.84 times 2.60 times Describe the difference between the terms 'liquidity and solvency. Indicate whether each of the above ratios is an example of liquidity or solvency. Compare the results of each companies' ratios to the other who has the better ratio result for each ratio and why? HTML Editore BIVA-N. IE * - B O NVG a * 1 * 12pt - Paragraph - O words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts