Question: Question 2 4 pts You have been tasked with managing the working capital for one of Home Depot's stores. Currently, its days inventory is 50

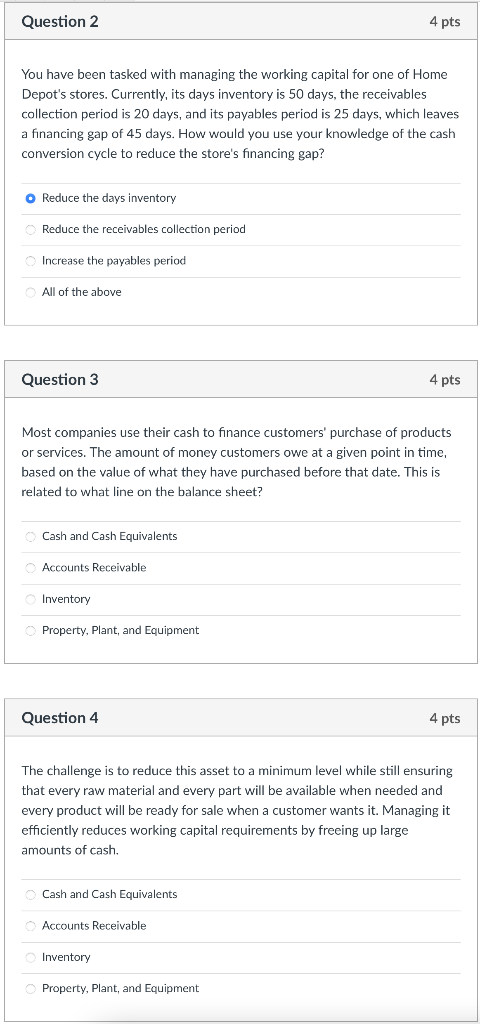

Question 2 4 pts You have been tasked with managing the working capital for one of Home Depot's stores. Currently, its days inventory is 50 days, the receivables collection period is 20 days, and its payables period is 25 days, which leaves a financing gap of 45 days. How would you use your knowledge of the cash conversion cycle to reduce the store's financing gap? o Reduce the days inventory Reduce the receivables collection period Increase the payables period All of the above Question 3 4 pts Most companies use their cash to finance customers' purchase of products or services. The amount of money customers owe at a given point in time, based on the value of what they have purchased before that date. This is related to what line on the balance sheet? Cash and Cash Equivalents Accounts Receivable Inventory Property, Plant, and Equipment Question 4 4 pts The challenge is to reduce this asset to a minimum level while still ensuring that every raw material and every part will be available when needed and every product will be ready for sale when a customer wants it. Managing it efficiently reduces working capital requirements by freeing up large amounts of cash. Cash and Cash Equivalents Accounts Receivable Inventory Property, Plant, and Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts