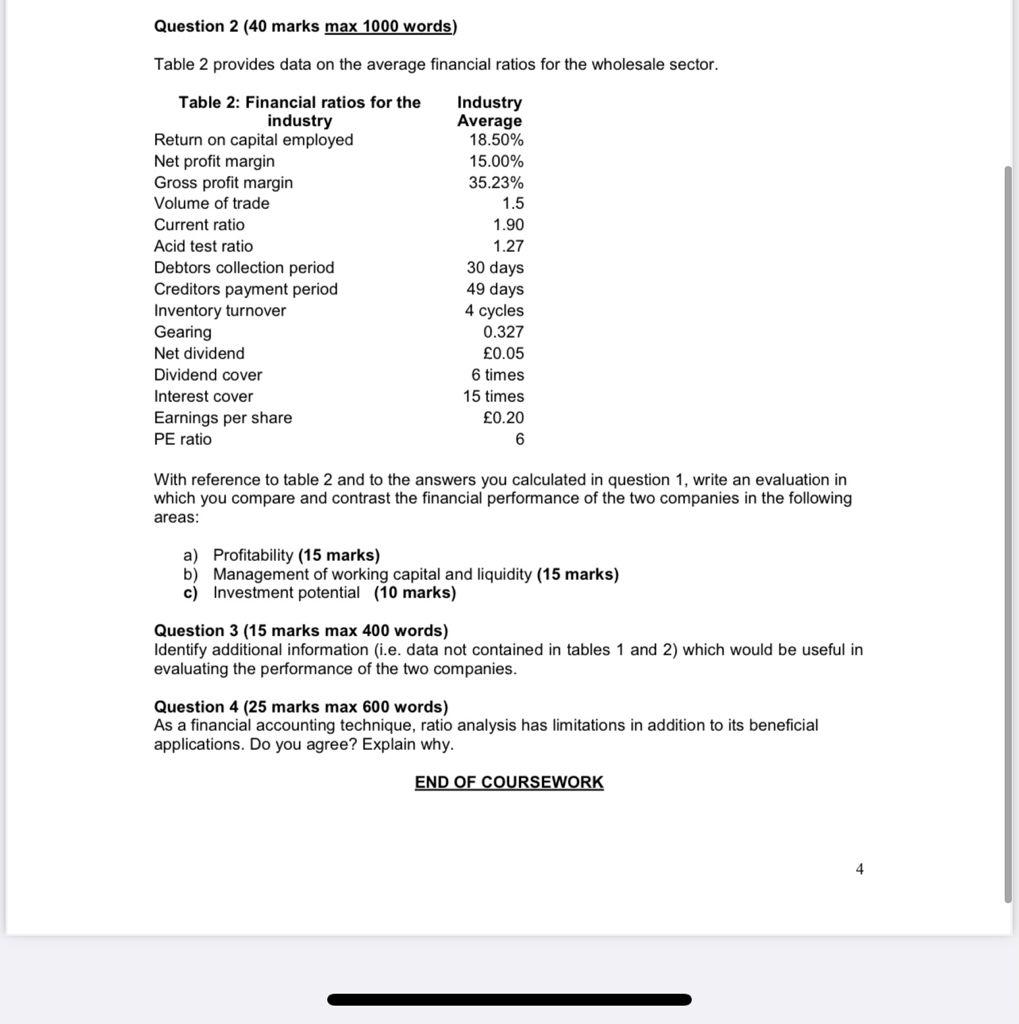

Question: Question 2 (40 marks max 1000 words) Table 2 provides data on the average financial ratios for the wholesale sector. Industry Average 18.50% 15.00% 35.23%

Question 2 (40 marks max 1000 words) Table 2 provides data on the average financial ratios for the wholesale sector. Industry Average 18.50% 15.00% 35.23% 1.5 1.90 1.27 Table 2: Financial ratios for the industry Return on capital employed Net profit margin Gross profit margin Volume of trade Current ratio Acid test ratio Debtors collection period Creditors payment period Inventory turnover Gearing Net dividend Dividend cover Interest cover Earnings per share PE ratio 30 days 49 days 4 cycles 0.327 0.05 6 times 15 times 0.20 6 With reference to table 2 and to the answers you calculated in question 1, write an evaluation in which you compare and contrast the financial performance of the two companies in the following areas: a) Profitability (15 marks) b) Management of working capital and liquidity (15 marks) c) Investment potential (10 marks) Question 3 (15 marks max 400 words) Identify additional information (i.e. data not contained in tables 1 and 2) which would be useful in evaluating the performance of the two companies. Question 4 (25 marks max 600 words) As a financial accounting technique, ratio analysis has limitations in addition to its beneficial applications. Do you agree? Explain why. END OF COURSEWORK 4 Question 2 (40 marks max 1000 words) Table 2 provides data on the average financial ratios for the wholesale sector. Industry Average 18.50% 15.00% 35.23% 1.5 1.90 1.27 Table 2: Financial ratios for the industry Return on capital employed Net profit margin Gross profit margin Volume of trade Current ratio Acid test ratio Debtors collection period Creditors payment period Inventory turnover Gearing Net dividend Dividend cover Interest cover Earnings per share PE ratio 30 days 49 days 4 cycles 0.327 0.05 6 times 15 times 0.20 6 With reference to table 2 and to the answers you calculated in question 1, write an evaluation in which you compare and contrast the financial performance of the two companies in the following areas: a) Profitability (15 marks) b) Management of working capital and liquidity (15 marks) c) Investment potential (10 marks) Question 3 (15 marks max 400 words) Identify additional information (i.e. data not contained in tables 1 and 2) which would be useful in evaluating the performance of the two companies. Question 4 (25 marks max 600 words) As a financial accounting technique, ratio analysis has limitations in addition to its beneficial applications. Do you agree? Explain why. END OF COURSEWORK 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts