Question: Question 2 (40 points): A firm has a 50% debt ratio as below, with COC = 10% on its assets, 5% on its debt, and

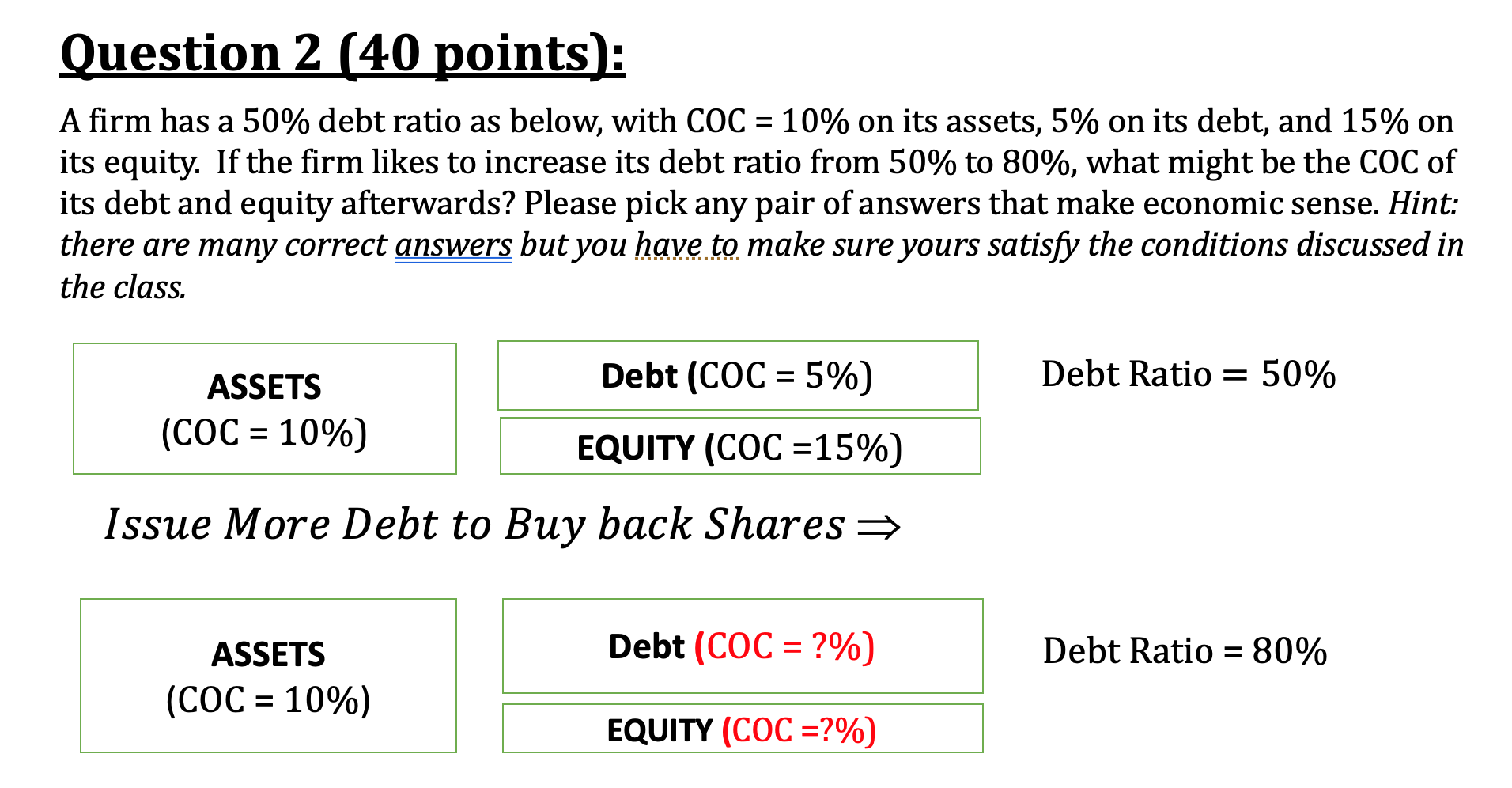

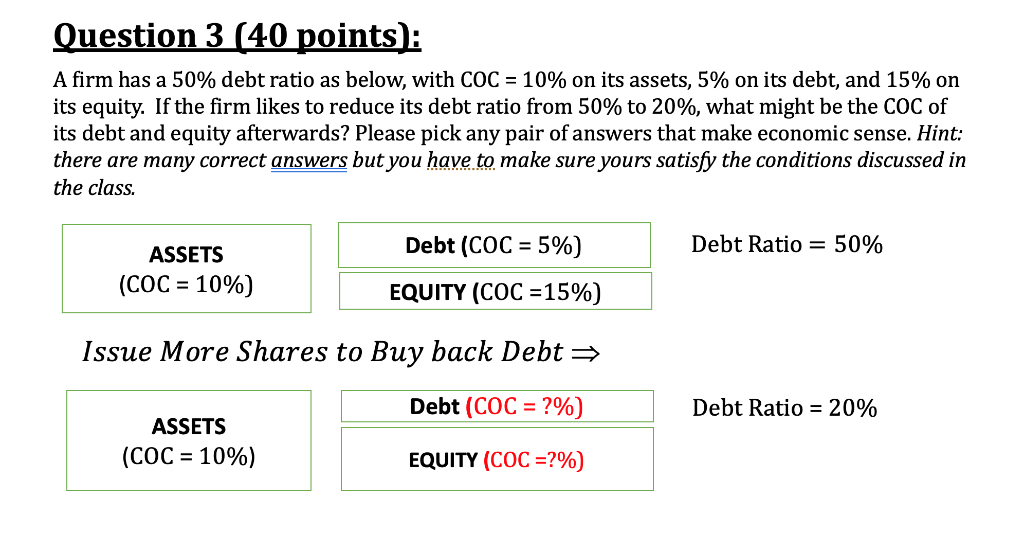

Question 2 (40 points): A firm has a 50% debt ratio as below, with COC = 10% on its assets, 5% on its debt, and 15% on its equity. If the firm likes to increase its debt ratio from 50% to 80%, what might be the COC of its debt and equity afterwards? Please pick any pair of answers that make economic sense. Hint: there are many correct answers but you have to make sure yours satisfy the conditions discussed in the class. Debt (COC = 5%) Debt Ratio = 50% ASSETS (COC = 10%) EQUITY (COC =15%) Issue More Debt to Buy back Shares Debt (COC = ?%) Debt Ratio = 80% ASSETS (COC = 10%) EQUITY (COC =?%) Question 3 (40 points): A firm has a 50% debt ratio as below, with COC = 10% on its assets, 5% on its debt, and 15% on its equity. If the firm likes to reduce its debt ratio from 50% to 20%, what might be the COC of its debt and equity afterwards? Please pick any pair of answers that make economic sense. Hint: there are many correct answers but you have to make sure yours satisfy the conditions discussed in the class. Debt Ratio = 50% ASSETS (COC = 10%) Debt (COC = 5%) EQUITY (COC =15%) Issue More Shares to Buy back Debt Debt (COC = ?%) Debt Ratio = 20% ASSETS (COC = 10%) EQUITY (COC =?%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts