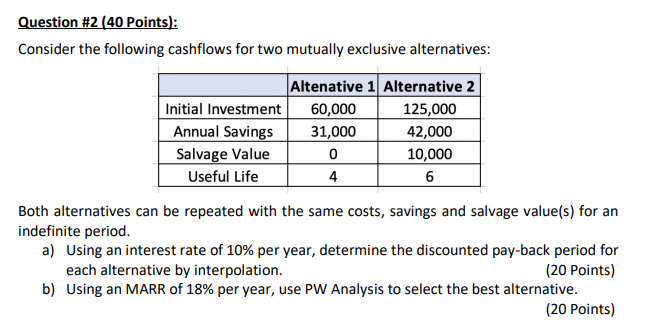

Question: Question #2 (40 Points): Consider the following cashflows for two mutually exclusive alternatives: Altenative 1 Alternative 2 Initial Investment 60,000 125,000 Annual Savings 31,000 42,000

Question #2 (40 Points): Consider the following cashflows for two mutually exclusive alternatives: Altenative 1 Alternative 2 Initial Investment 60,000 125,000 Annual Savings 31,000 42,000 Salvage Value 0 10,000 Useful Life 4 6 Both alternatives can be repeated with the same costs, savings and salvage value(s) for an indefinite period. a) Using an interest rate of 10% per year, determine the discounted pay-back period for each alternative by interpolation. (20 Points) b) Using an MARR of 18% per year, use PW Analysis to select the best alternative. (20 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts