Question: Question 2. (40%) With interest rates equal to 0% per quarter, a stock S valued at $1 today can go up or down in price

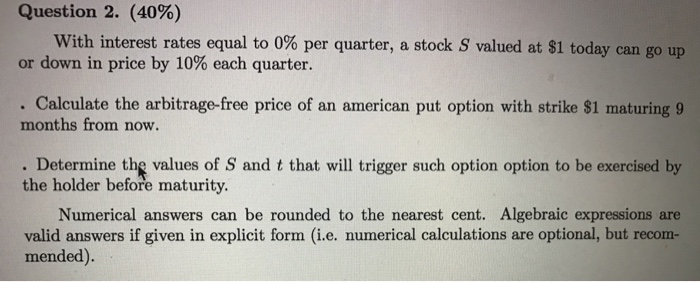

Question 2. (40%) With interest rates equal to 0% per quarter, a stock S valued at $1 today can go up or down in price by 10% each quarter. Calculate the arbitrage-free price of an american put option with strike $1 maturing 9 months from now. . Determine the values of S and t that will trigger such option option to be exercised by the holder before maturity. Numerical answers can be rounded to the nearest cent. Algebraic expressions are valid answers if given in explicit form (i.e. numerical calculations are optional, but recom- mended)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock