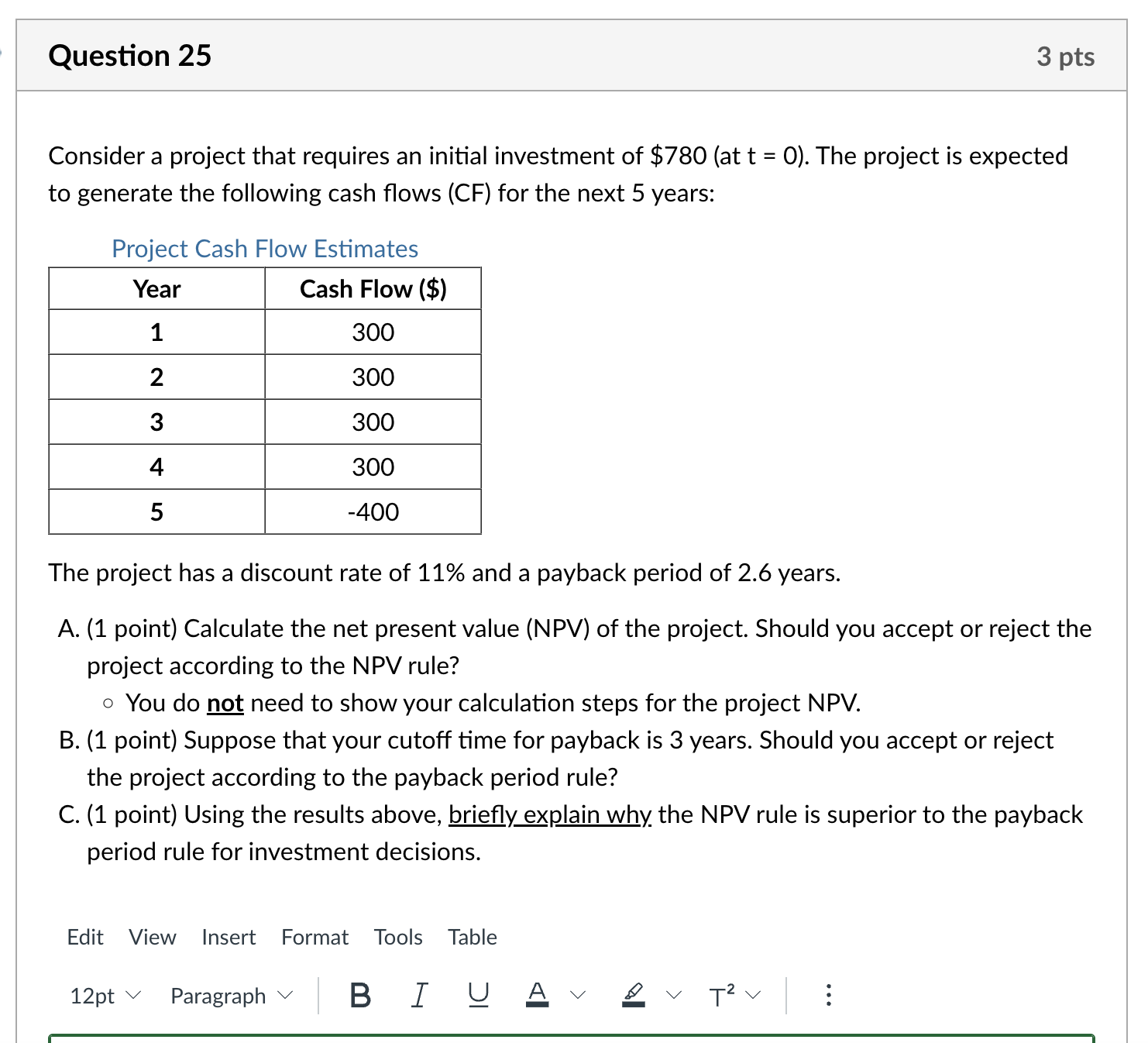

Question: Question 2 5 Consider a project that requires an initial investment of $ 7 8 0 ( at t = 0 ) . The project

Question

Consider a project that requires an initial investment of $at The project is expected

to generate the following cash flows CF for the next years:

Project Cash Flow Estimates

The project has a discount rate of and a payback period of years.

A point Calculate the net present value NPV of the project. Should you accept or reject the

project according to the NPV rule?

You do not need to show your calculation steps for the project NPV

B point Suppose that your cutoff time for payback is years. Should you accept or reject

the project according to the payback period rule?

C point Using the results above, briefly explain why the NPV rule is superior to the payback

period rule for investment decisions.

Edit View Insert Format Tools Table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock