Question: Question 2 5 of 7 5 . When Naren sent her son Brett to college, she purchased a house near campus for $ 3 4

Question of

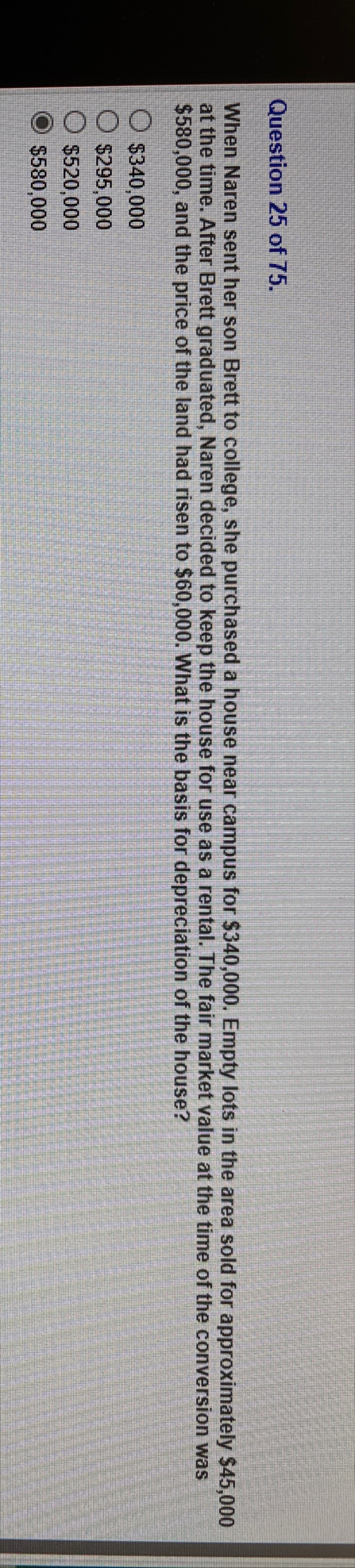

When Naren sent her son Brett to college, she purchased a house near campus for $ Empty lots in the area sold for approximately $ at the time. After Brett graduated, Naren decided to keep the house for use as a rental. The fair market value at the time of the conversion was $ and the price of the land had risen to $ What is the basis for depreciation of the house?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock