Question: Question 2 (5 points) (5 Points). What should be the price (Po) for a common stock paying $5.50 annually in dividends if the growth rate

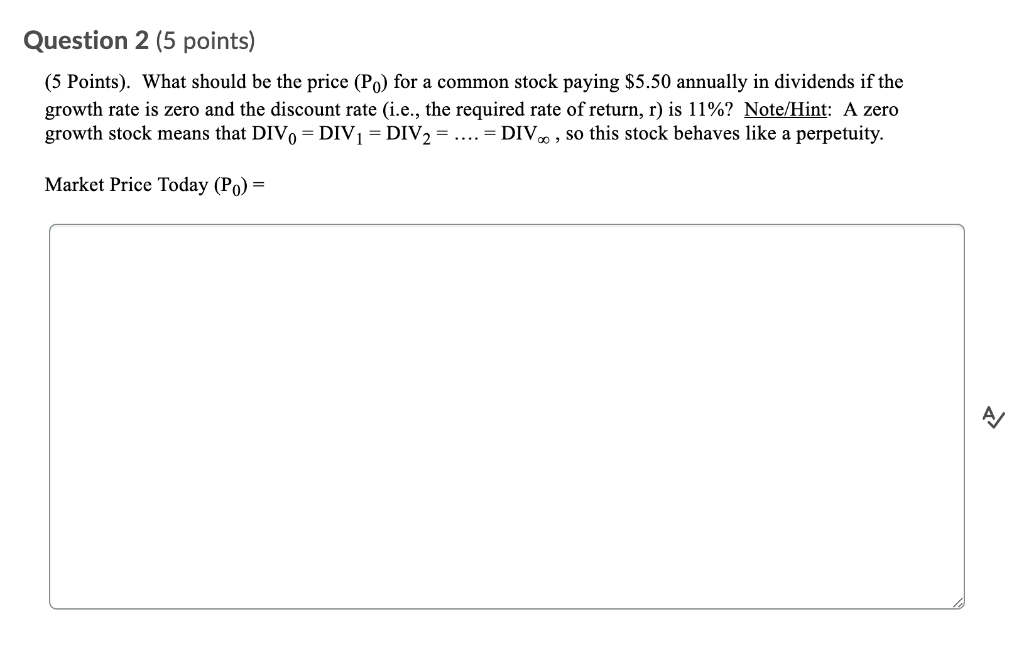

Question 2 (5 points) (5 Points). What should be the price (Po) for a common stock paying $5.50 annually in dividends if the growth rate is zero and the discount rate (i.e., the required rate of return, r) is 11%? Note/Hint: A zero growth stock means that DIVO = DIV1 = DIV2 = .... = DIV, so this stock behaves like a perpetuity. Market Price Today (P) =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts