Question: Question 2 5 Points A large industry bond carries a coupon rate of 7% and has a face value of $1000. The bond has 12

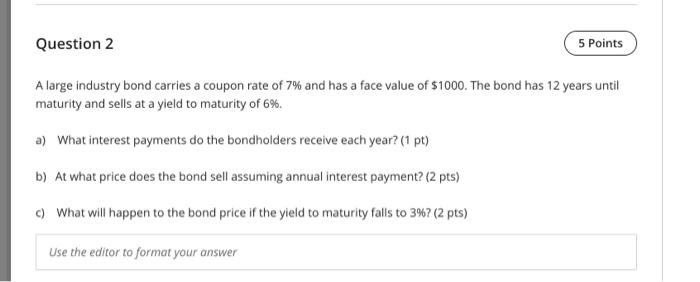

Question 2 5 Points A large industry bond carries a coupon rate of 7% and has a face value of $1000. The bond has 12 years until maturity and sells at a yield to maturity of 6%. a) What interest payments do the bondholders receive each year? (1 pt) b) At what price does the bond sell assuming annual interest payment? (2 pts) c) What will happen to the bond price if the yield to maturity falls to 3%? (2 pts) Use the editor to format your

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock