Question: Question 2 (5 Points) Consider a call option on IBM stock with strike price of $55 and which has 6- months until expiration. The current

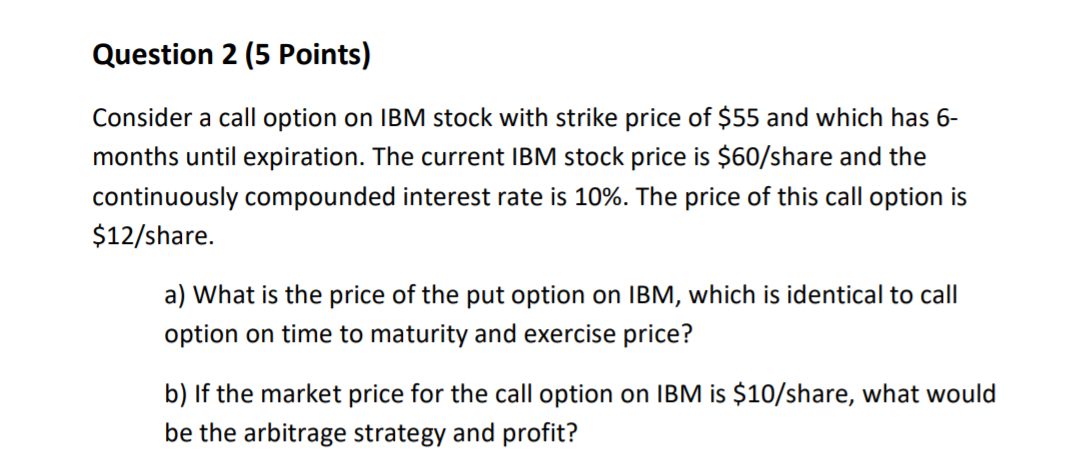

Question 2 (5 Points) Consider a call option on IBM stock with strike price of $55 and which has 6- months until expiration. The current IBM stock price is $60/share and the continuously compounded interest rate is 10%. The price of this call option is $12/share. a) What is the price of the put option on IBM, which is identical to call option on time to maturity and exercise price? b) If the market price for the call option on IBM is $10/share, what would be the arbitrage strategy and profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts