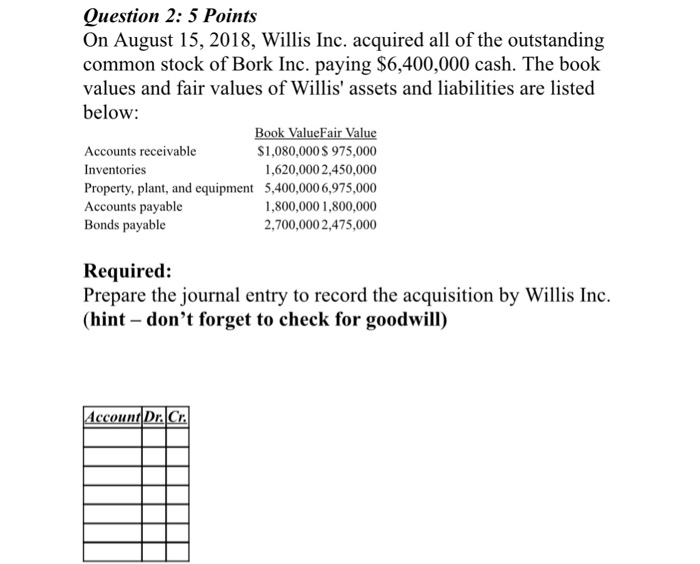

Question: Question 2: 5 Points On August 15, 2018, Willis Inc. acquired all of the outstanding common stock of Bork Inc. paying $6,400,000 cash. The book

Question 2: 5 Points On August 15, 2018, Willis Inc. acquired all of the outstanding common stock of Bork Inc. paying $6,400,000 cash. The book values and fair values of Willis' assets and liabilities are listed below: Accounts receivable Inventories Property, plant, and equipment Accounts payable Bonds payable Book ValueFair Value $1,080,000S 975,000 1,620,0002,450,000 5,400,0006,975,000 1,800,000 1,800,00 2,700,0002,475,000 Required: Prepare the journal entry to record the acquisition by Willis Inc. (hint - don't forget to check for goodwill)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts