Question: QUESTION 2 5 points Save Answer 1. An investor can invest in 2 assets: a government Tbill with a certain return of 0.03, and the

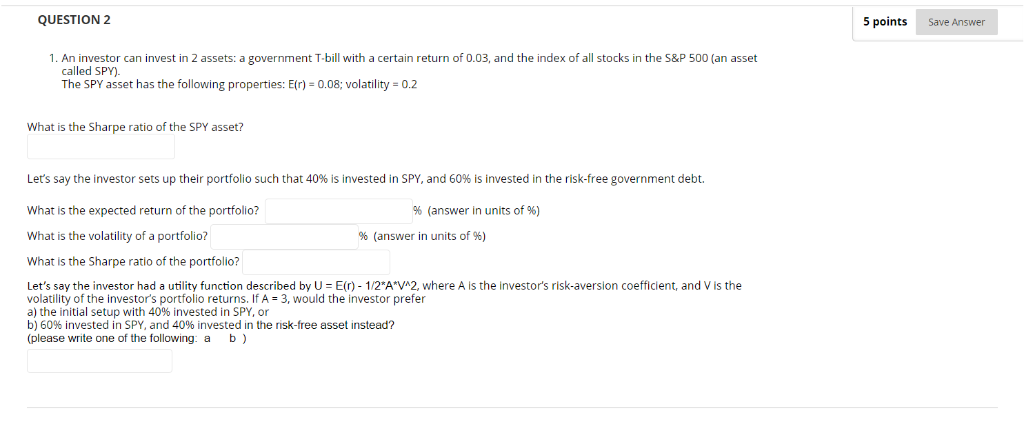

QUESTION 2 5 points Save Answer 1. An investor can invest in 2 assets: a government Tbill with a certain return of 0.03, and the index of all stocks in the S&P 500 (an asset called SPY) The SPY asset has the following properties: Etr)-0.08; volatility-0.2 is the Sharpe ratio of the SPY asset? Let's say the investor sets up their portfolio such that 40% is invested in SPY, and 6096 is invested in the risk-free government debt. What is the expected return of the portfolio? What is the volatility of a portfolio? What is the Sharpe ratio of the portfolio? 96 (answer in units of %) % (answer in units of 96) Let's say the investor had a utility function described by U E(r)-1/2*A"V"2, where A is the investor's risk-aversion coefficient, and V is the volatility of the investor's portfolio returns. If A 3, would the investor prefer a) the initial setup with 40% invested in SPY, or b) 60% invested in SPY, and 40% invested in the risk-free asset instead? (please write one of the following: a b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts