Question: Question 2 5 points Save Answer It is December 2020 and you are examining the financial statements of Baxter Industries (see below). You know that

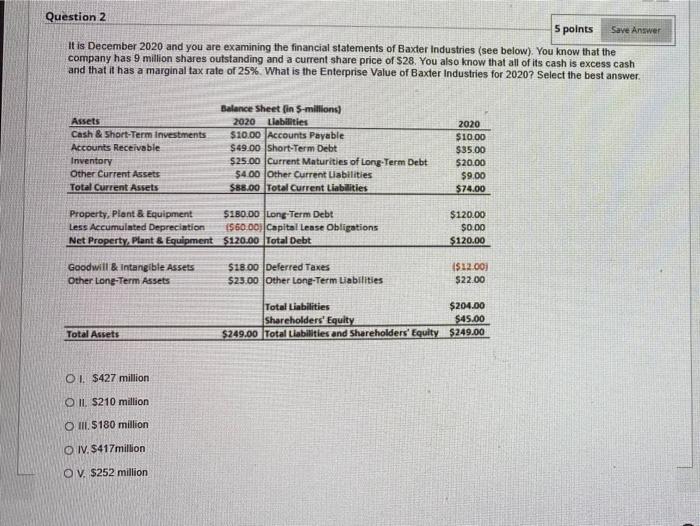

Question 2 5 points Save Answer It is December 2020 and you are examining the financial statements of Baxter Industries (see below). You know that the company has 9 million shares outstanding and a current share price of $28. You also know that all of its cash is excess cash and that it has a marginal tax rate of 25%. What is the Enterprise Value of Baxter Industries for 2020? Select the best answer. Assets Cash & Short-Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Balance Sheet (in 5-millions) 2020 Llabilities $10.00 Accounts Payable $49.00 Short-Term Debt $25.00 Current Maturities of Long-Term Debt $4.00 Other Current Liabilities $88.00 Total Current Liabilities 2020 $10.00 $35.00 $20.00 $9.00 $74.00 Property, Plant & Equipment $180.00 Long Term Debt Less Accumulated Depreciation 1560.00j|Capital Lease Obligations Net Property Plant & Equipment $120.00 Total Debt $120.00 $0.00 $120.00 Goodwill & Intangible Assets Other Long-Term Assets $18.00 Deferred Taxes $23.00 Other Long-Term Liabilities $12.00 $22.00 Total Liabilities $204.00 Shareholders' Equity $45.00 $249.00 Total Liabilities and Shareholders' Equity $249.00 Total Assets OI. $427 million O II S210 million O III. $180 million O IV. $417 million OV. $252 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts