Question: Question 2 (5 points) Vision Inc. is considering leasing an equipment. The equipment costs $3,000,000 and it would be depreciated straight-line to zero over 4

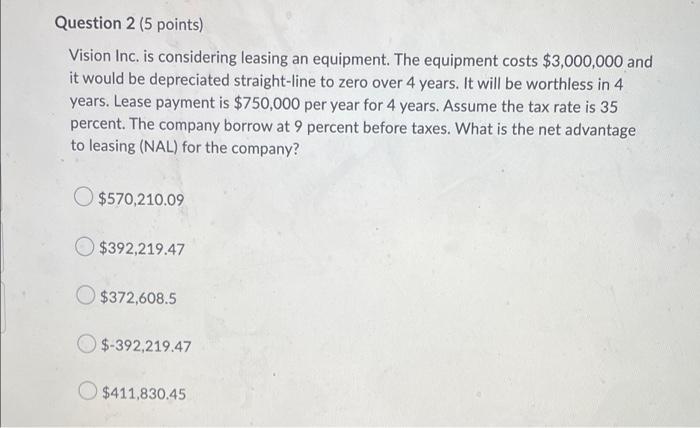

Question 2 (5 points) Vision Inc. is considering leasing an equipment. The equipment costs $3,000,000 and it would be depreciated straight-line to zero over 4 years. It will be worthless in 4 years. Lease payment is $750,000 per year for 4 years. Assume the tax rate is 35 percent. The company borrow at 9 percent before taxes. What is the net advantage to leasing (NAL) for the company? $570,210.09 $392,219.47 $372,608.5 $-392,219.47 $411,830.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts