Question: Question 2 5 pts [Your answer must be supported by relevant IFRS/PSAK standard] [Show your computation] PT. Teknologi Utama (TU) provides hardware, software and IT

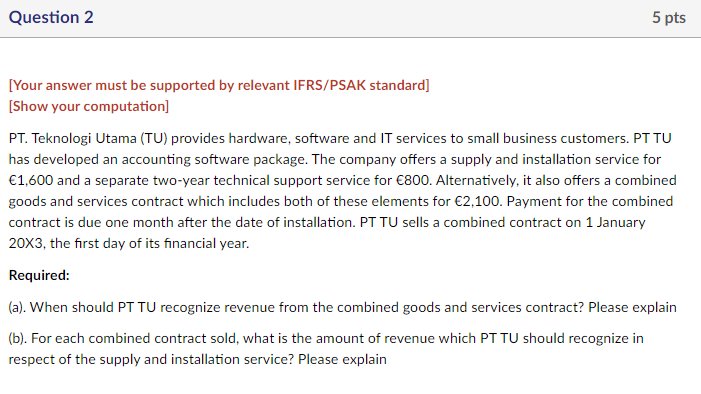

Question 2 5 pts [Your answer must be supported by relevant IFRS/PSAK standard] [Show your computation] PT. Teknologi Utama (TU) provides hardware, software and IT services to small business customers. PT TU has developed an accounting software package. The company offers a supply and installation service for 1,600 and a separate two-year technical support service for 800. Alternatively, it also offers a combined goods and services contract which includes both of these elements for 2,100. Payment for the combined contract is due one month after the date of installation. PT TU sells a combined contract on 1 January 20X3, the first day of its financial year. Required: (a). When should PT TU recognize revenue from the combined goods and services contract? Please explain (b). For each combined contract sold, what is the amount of revenue which PT TU should recognize in respect of the supply and installation service? Please explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts