Question: QUESTION 2 50 marks Cooper & Hooper is an accounting firm that rendering audit service to its clients. The firm uses job-costing system. There are

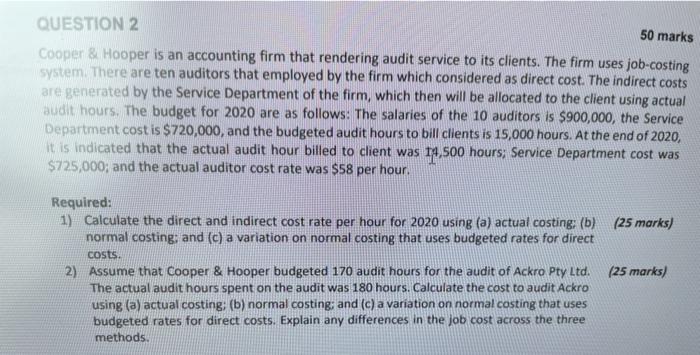

QUESTION 2 50 marks Cooper & Hooper is an accounting firm that rendering audit service to its clients. The firm uses job-costing system. There are ten auditors that employed by the firm which considered as direct cost. The indirect costs are generated by the Service Department of the firm, which then will be allocated to the client using actual audit hours. The budget for 2020 are as follows: The salaries of the 10 auditors is $900,000, the Service Department cost is $720,000, and the budgeted audit hours to bill clients is 15,000 hours. At the end of 2020, it is indicated that the actual audit hour billed to client was 14.500 hours: Service Department cost was $725,000; and the actual auditor cost rate was $58 per hour. Required: 1) Calculate the direct and indirect cost rate per hour for 2020 using (a) actual costing: (b) (25 marks) normal costing: and (c) a variation on normal costing that uses budgeted rates for direct costs. 2). Assume that Cooper & Hooper budgeted 170 audit hours for the audit of Ackro Pty Ltd. (25 marks) The actual audit hours spent on the audit was 180 hours. Calculate the cost to audit Ackro using (a)actual costing; (b) normal costing: and (c) a variation on normal costing that uses budgeted rates for direct costs. Explain any differences in the job cost across the three methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts