Question: QUESTION 2) (50 Points) Cce is a corporation which has $30 millions in EBITDA on revenues of $100 millions in the recent year. You're the

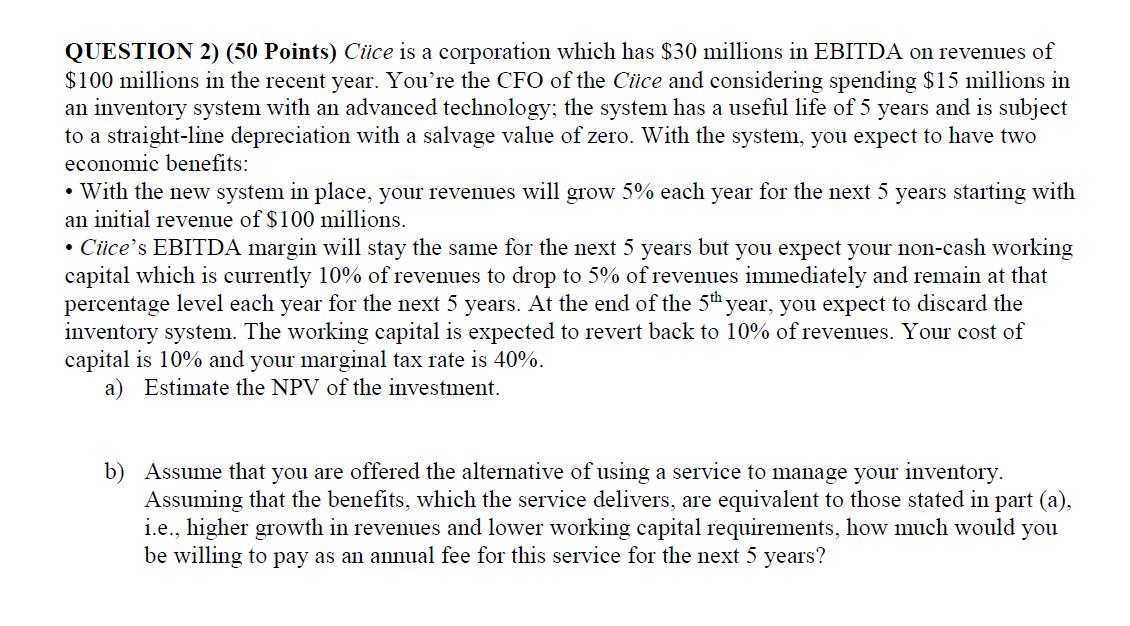

QUESTION 2) (50 Points) Cce is a corporation which has $30 millions in EBITDA on revenues of $100 millions in the recent year. You're the CFO of the Cce and considering spending $15 millions in an inventory system with an advanced technology; the system has a useful life of 5 years and is subject to a straight-line depreciation with a salvage value of zero. With the system, you expect to have two economic benefits: With the new system in place, your revenues will grow 5% each year for the next 5 years starting with an initial revenue of $100 millions. Cce's EBITDA margin will stay the same for the next 5 years but you expect your non-cash working capital which is currently 10% of revenues to drop to 5% of revenues immediately and remain at that percentage level each year for the next 5 years. At the end of the 5th year, you expect to discard the inventory system. The working capital is expected to revert back to 10% of revenues. Your cost of capital is 10% and your marginal tax rate is 40%. a) Estimate the NPV of the investment. b) Assume that you are offered the alternative of using a service to manage your inventory. Assuming that the benefits, which the service delivers, are equivalent to those stated in part (a), i.e., higher growth in revenues and lower working capital requirements, how much would you be willing to pay as an annual fee for this service for the next 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts