Question: Question 2 : (54 marks) Explain the double entry principle and apply the principle to analyse the financial transactions shown in Appendix A to this

Question 2: (54 marks)

- Explain the double entry principle and apply the principle to analyse the financial transactions shown in Appendix A to this brief (financial transactions of Anna & Akwasi Tutorial Partnership. You are to explain how the first three transactions will be recorded in the books of accounts, stating the accounts to be credited and those to be debited. (12 marks)

- Using all the financial transactions in Appendix A prepare ledger accounts in the books of Anna & Akwasi Tutorial Partnership, balance off the accounts and extract a trial balance for the period. (30 marks))

- Explain the need for a trial balance, and show the extent to which businesses can rely on a trial balance as part of the process of financial reporting. (4 marks)

- Give and explain two (2) examples of errors that do not affect the agreement of a trial balance, and Illustrate how those errors can be corrected using journal entries. (8 marks)

Question 3: (40 marks)

- Explain whether or not the following are, or can be, stakeholders of Anna & Akwasi Tutorial Partnership: (i) NatWest Bank, (ii) Trade Unions, (iii) Management, and (iv) Parents of students of Anna & Akwasi Tutorial Partnership. Give reasons. . (12 marks)

- Explain the need and use of financial information for each of the stakeholders, where applicable. Give examples of specific financial information they may need to support your answer in each stakeholders case, where applicable, and explain the usefulness of the specific information so indicated. Examples of financial information include, but not limited to, income statements, statements of financial position, cash budgets and breakeven analysis. (16 marks)

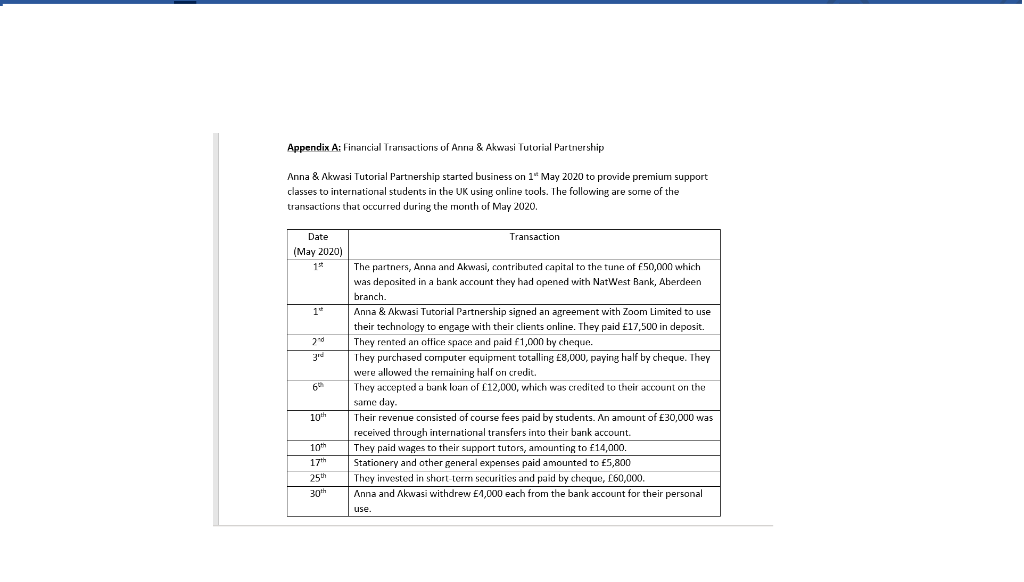

Appendix A: Financial Transactions of Anna & Akwasi Tutorial Partnership Anna & Akwasi Tutorial Partnership started business on 16 May 2020 to provide premium support classes to international students in the UK using online tools. The following are some of the transactions that occurred during the month of May 2020. Transaction Date (May 2020) 154 The partners, Anna and Akwasi, contributed capital to the tune of f50,000 which was deposited in a bank account they had opened with NatWest Bank, Aberdeen branch. Anna & Akwasi Tutorial Partnership signed an agreement with Zoom Limited to use their technology to engage with their clients online. They paid 17,500 in deposit. They rented an office space and paid f1,000 by cheque. They purchased computer equipment totalling 8,000, paying half by cheque. They were allowed the remaining half on credit. They accepted a bank loan of C12,000, which was credited to their account on the 20 34 6 Same day. 10 10th 17th 25th 30th Their revenue consisted of course fees paid by students. An amount of 30,000 was received through international transfers into their bank account. They paid wages to their support tutors, amounting to f14,000. Stationery and other general expenses paid amounted to 5,800 They invested in short term securities and paid by cheque, 160,000. Anna and Akwasi withdrew 4,000 each from the bank account for their personal use Appendix A: Financial Transactions of Anna & Akwasi Tutorial Partnership Anna & Akwasi Tutorial Partnership started business on 16 May 2020 to provide premium support classes to international students in the UK using online tools. The following are some of the transactions that occurred during the month of May 2020. Transaction Date (May 2020) 154 The partners, Anna and Akwasi, contributed capital to the tune of f50,000 which was deposited in a bank account they had opened with NatWest Bank, Aberdeen branch. Anna & Akwasi Tutorial Partnership signed an agreement with Zoom Limited to use their technology to engage with their clients online. They paid 17,500 in deposit. They rented an office space and paid f1,000 by cheque. They purchased computer equipment totalling 8,000, paying half by cheque. They were allowed the remaining half on credit. They accepted a bank loan of C12,000, which was credited to their account on the 20 34 6 Same day. 10 10th 17th 25th 30th Their revenue consisted of course fees paid by students. An amount of 30,000 was received through international transfers into their bank account. They paid wages to their support tutors, amounting to f14,000. Stationery and other general expenses paid amounted to 5,800 They invested in short term securities and paid by cheque, 160,000. Anna and Akwasi withdrew 4,000 each from the bank account for their personal use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts