Question: Question 2 6 / 10 | - 100%+ (a) (b) (c) A company just paid $4.50 dividends per share. The next dividend is not

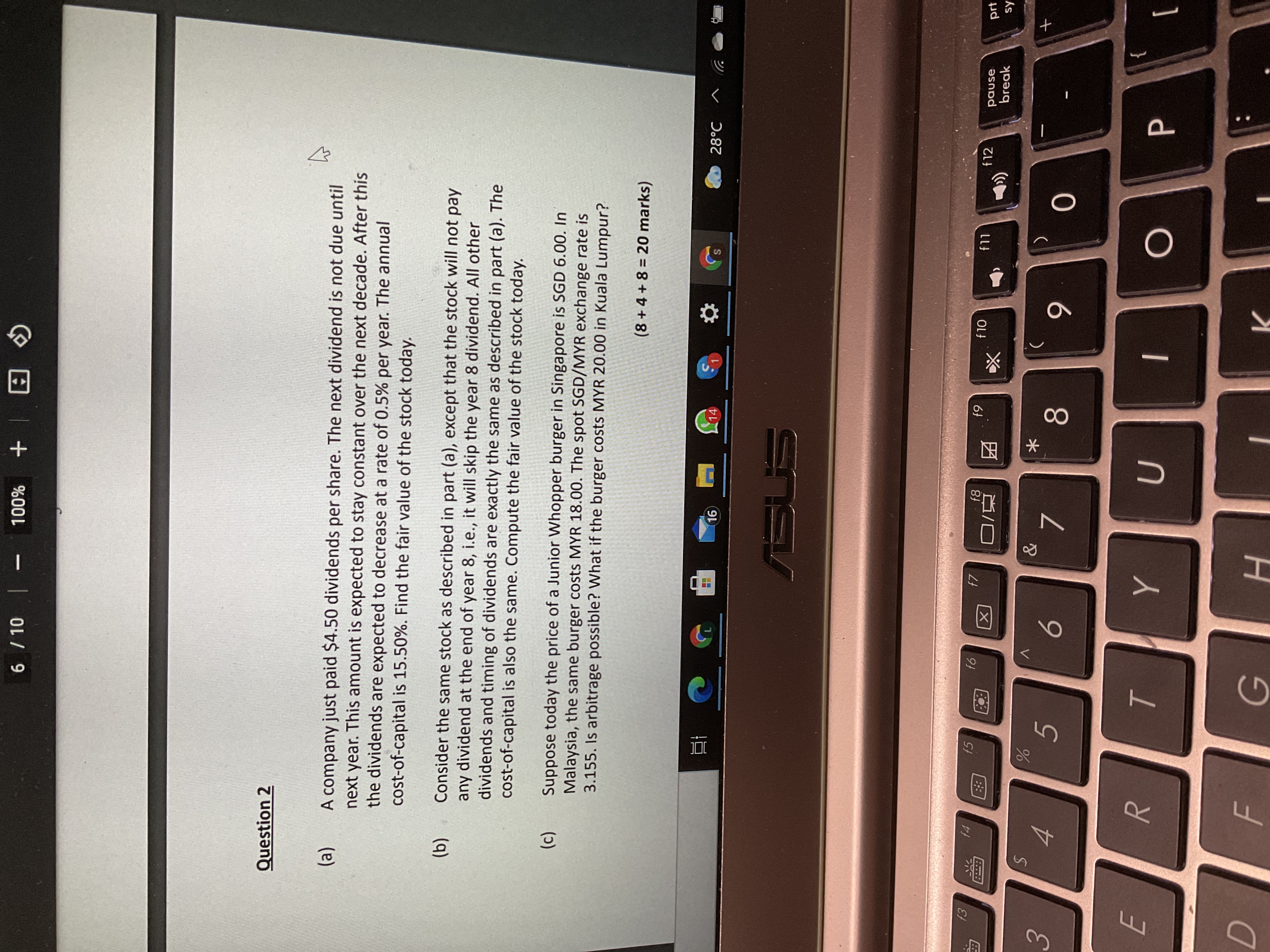

Question 2 6 / 10 | - 100%+ (a) (b) (c) A company just paid $4.50 dividends per share. The next dividend is not due until next year. This amount is expected to stay constant over the next decade. After this the dividends are expected to decrease at a rate of 0.5% per year. The annual cost-of-capital is 15.50%. Find the fair value of the stock today. Consider the same stock as described in part (a), except that the stock will not pay any dividend at the end of year 8, i.e., it will skip the year 8 dividend. All other dividends and timing of dividends are exactly the same as described in part (a). The cost-of-capital is also the same. Compute the fair value of the stock today. Suppose today the price of a Junior Whopper burger in Singapore is SGD 6.00. In Malaysia, the same burger costs MYR 18.00. The spot SGD/MYR exchange rate is 3.155. Is arbitrage possible? What if the burger costs MYR 20.00 in Kuala Lumpur? f3 f4 E f5 3 S 4 % f6 5 6. 16 14 ASUS f7 & f8 H (8+4+8 = 20 marks) S 28C f9 f10 +11 f12 7 8 9 0 E R T Y U D F I P pause break + prt sy [

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts