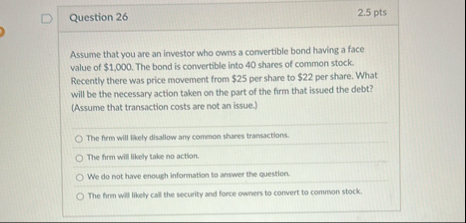

Question: Question 2 6 2 . 5 pts Assume that you are an investor who owns a comvertible bond having a face value of $ 1

Question

pts

Assume that you are an investor who owns a comvertible bond having a face value of $ The bond is convertible into shares of common stock. Recently there was price movement from $ per share to $ per share. What will be the necessary action taken on the part of the firm that issued the debt? Assume that transaction costs are not an issue.

The firm will likely disallow any common shares transactions.

The firm wht tincly thie no action.

We do not have enough information to answer the question.

The firm wift thaty cat the security and force ommers to comvert to common stock.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock