Question: Question 2 (6 marks) Sur Airways SAOG placed an order to buy a new aircraft from New Aircorp ( a UK company) in January. The

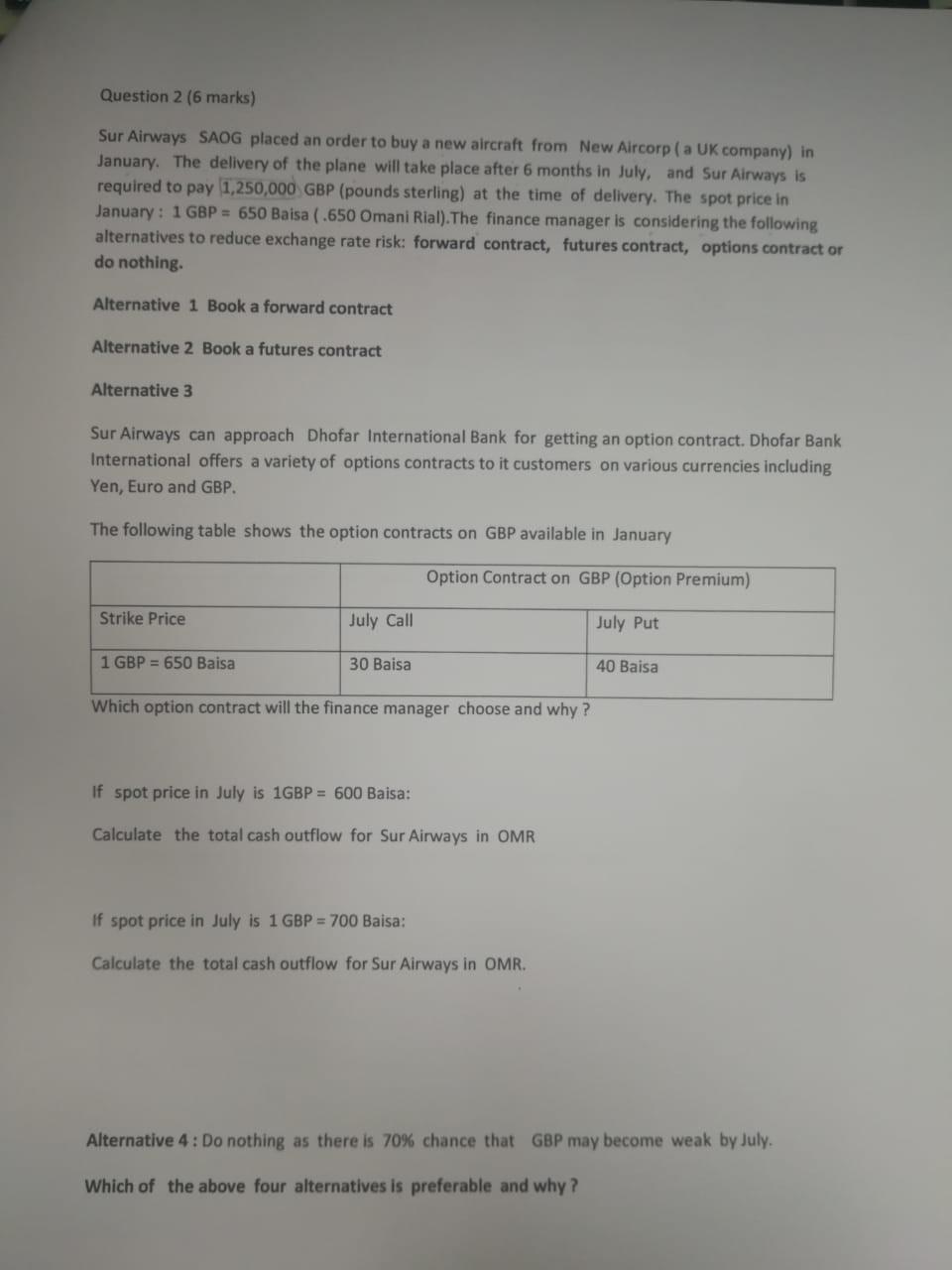

Question 2 (6 marks) Sur Airways SAOG placed an order to buy a new aircraft from New Aircorp ( a UK company) in January. The delivery of the plane will take place after 6 months in July, and Sur Airways is required to pay 1,250,000 GBP (pounds sterling) at the time of delivery. The spot price in January: 1 GBP = 650 Baisa (.650 Omani Rial). The finance manager is considering the following alternatives to reduce exchange rate risk: forward contract, futures contract, options contract or do nothing. Alternative 1 Book a forward contract Alternative 2 Book a futures contract Alternative 3 Sur Airways can approach Dhofar International Bank for getting an option contract. Dhofar Bank International offers a variety of options contracts to it customers on various currencies including Yen, Euro and GBP. The following table shows the option contracts on GBP available in January Option Contract on GBP (Option Premium) Strike Price July Call July Put 1 GBP = 650 Baisa 30 Baisa 40 Baisa Which option contract will the finance manager choose and why? If spot price in July is 1GBP = 600 Baisa: Calculate the total cash outflow for Sur Airways in OMR If spot price in July is 1 GBP = 700 Baisa: Calculate the total cash outflow for Sur Airways in OMR. Alternative 4: Do nothing as there is 70% chance that GBP may become weak by July. Which of the above four alternatives is preferable and why? Question 2 (6 marks) Sur Airways SAOG placed an order to buy a new aircraft from New Aircorp ( a UK company) in January. The delivery of the plane will take place after 6 months in July, and Sur Airways is required to pay 1,250,000 GBP (pounds sterling) at the time of delivery. The spot price in January: 1 GBP = 650 Baisa (.650 Omani Rial). The finance manager is considering the following alternatives to reduce exchange rate risk: forward contract, futures contract, options contract or do nothing. Alternative 1 Book a forward contract Alternative 2 Book a futures contract Alternative 3 Sur Airways can approach Dhofar International Bank for getting an option contract. Dhofar Bank International offers a variety of options contracts to it customers on various currencies including Yen, Euro and GBP. The following table shows the option contracts on GBP available in January Option Contract on GBP (Option Premium) Strike Price July Call July Put 1 GBP = 650 Baisa 30 Baisa 40 Baisa Which option contract will the finance manager choose and why? If spot price in July is 1GBP = 600 Baisa: Calculate the total cash outflow for Sur Airways in OMR If spot price in July is 1 GBP = 700 Baisa: Calculate the total cash outflow for Sur Airways in OMR. Alternative 4: Do nothing as there is 70% chance that GBP may become weak by July. Which of the above four alternatives is preferable and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts