Question: QUESTION 2: (6 points, 2 points each section) You own 100 shares of Amazon.Com. The current share price is $720. You expect that the share

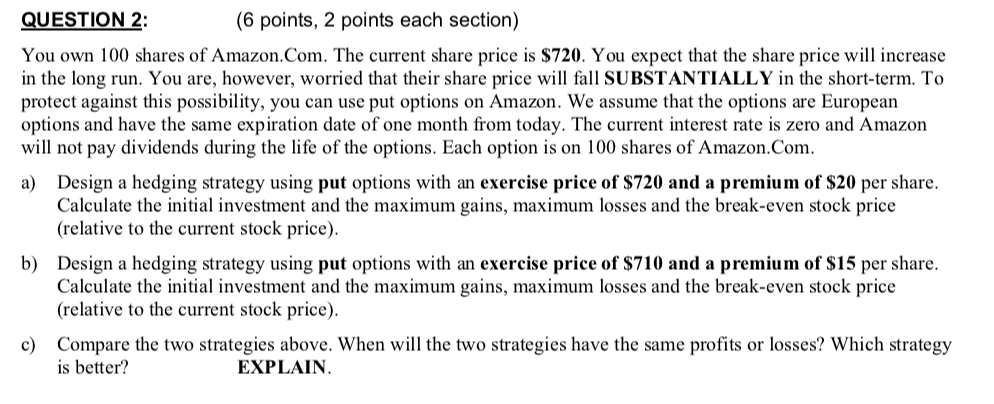

QUESTION 2: (6 points, 2 points each section) You own 100 shares of Amazon.Com. The current share price is $720. You expect that the share price will increase in the long run. You are, however, worried that their share price will fall SUBSTANTIALLY in the short-term. To protect against this possibility, you can use put options on Amazon. We assume that the options are European options and have the same expiration date of one month from today. The current interest rate is zero and Amazon will not pay dividends during the life of the options. Each option is on 100 shares of Amazon.Com. a) Design a hedging strategy using put options with an exercise price of $720 and a premium of $20 per share. Calculate the initial investment and the maximum gains, maximum losses and the break-even stock price (relative to the current stock price). b) Design a hedging strategy using put options with an exercise price of $710 and a premium of $15 per share. Calculate the initial investment and the maximum gains, maximum losses and the break-even stock price (relative to the current stock price). c) Compare the two strategies above. When will the two strategies have the same profits or losses? Which strategy is better? EXPLAIN. QUESTION 2: (6 points, 2 points each section) You own 100 shares of Amazon.Com. The current share price is $720. You expect that the share price will increase in the long run. You are, however, worried that their share price will fall SUBSTANTIALLY in the short-term. To protect against this possibility, you can use put options on Amazon. We assume that the options are European options and have the same expiration date of one month from today. The current interest rate is zero and Amazon will not pay dividends during the life of the options. Each option is on 100 shares of Amazon.Com. a) Design a hedging strategy using put options with an exercise price of $720 and a premium of $20 per share. Calculate the initial investment and the maximum gains, maximum losses and the break-even stock price (relative to the current stock price). b) Design a hedging strategy using put options with an exercise price of $710 and a premium of $15 per share. Calculate the initial investment and the maximum gains, maximum losses and the break-even stock price (relative to the current stock price). c) Compare the two strategies above. When will the two strategies have the same profits or losses? Which strategy is better? EXPLAIN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts