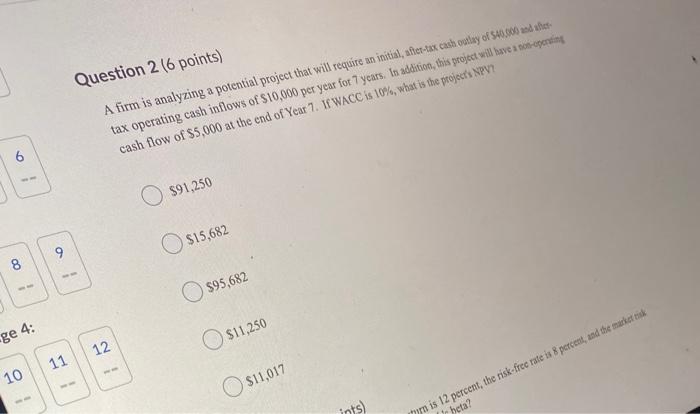

Question: Question 2 (6 points) A firm is analyzing a potential project that will require an initial, after-tax cash outlay of S. and the tax operating

Question 2 (6 points) A firm is analyzing a potential project that will require an initial, after-tax cash outlay of S. and the tax operating cash inflows of $10,000 per year for 7 years. In addition, this project will have a ton opening cash flow of $5,000 at the end of Year 7. TE WACC is 10%, what is the project's NPV? 6 O $91,250 O $15,682 9 8 895,682 ge 4: O $11,250 12 11 10 $11,017 ints) Tim is 12 percent, the risk-free rate is 8 percent, and the market tik sheta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts