Question: Question 2 (6 points) Consider the following 2 mutually exclusive projects. The manager doesn't know yet what required rate of return to use. If the

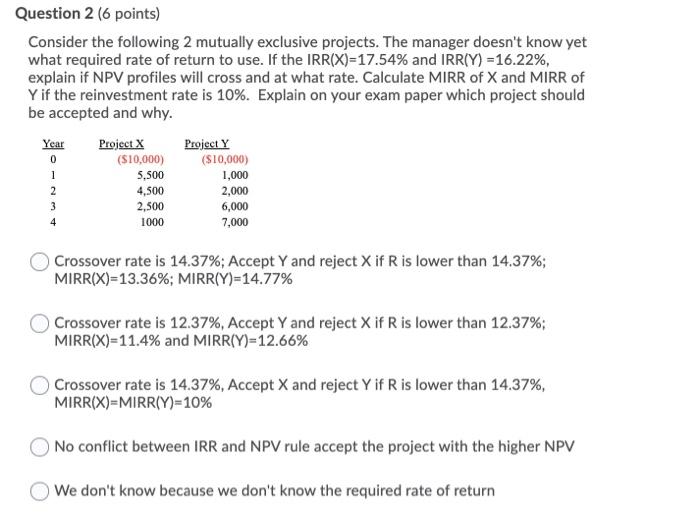

Question 2 (6 points) Consider the following 2 mutually exclusive projects. The manager doesn't know yet what required rate of return to use. If the IRR(X)=17.54% and IRR(Y) = 16.22%, explain if NPV profiles will cross and at what rate. Calculate MIRR of X and MIRR of Y if the reinvestment rate is 10%. Explain on your exam paper which project should be accepted and why. Year 0 1 2 3 4 Project X ($10,000) 5,500 4,500 2,500 1000 Project Y ($10,000) 1,000 2,000 6,000 7,000 Crossover rate is 14.37%; Accept Y and reject X if R is lower than 14.37%; MIRR(X)=13.36%; MIRR(Y)=14.77% Crossover rate is 12.37%, Accept Y and reject X if Ris lower than 12.37%; MIRR(X)=11.4% and MIRR(Y)=12.66% Crossover rate is 14.37%, Accept X and reject Y if R is lower than 14.37%, MIRR(X)=MIRR(Y)=10% No conflict between IRR and NPV rule accept the project with the higher NPV We don't know because we don't know the required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts